EV Industry Faces Challenges and Uncertainty in 2025

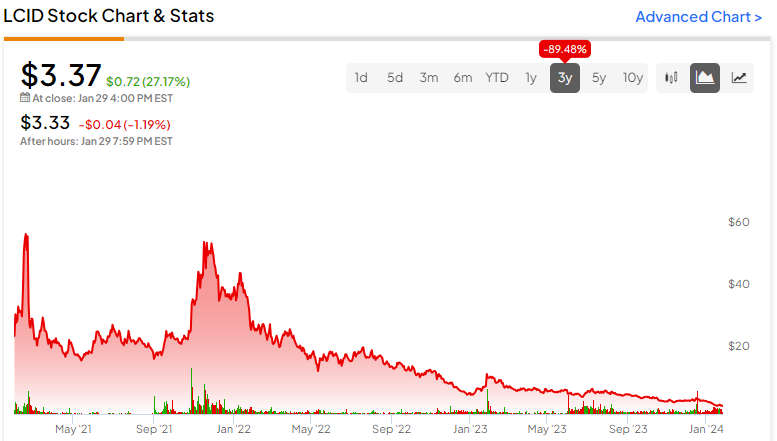

In 2025, Tesla, Rivian, and Lucid faced significant headwinds from policy changes, tariffs, and market shifts, leading to slower sales and higher costs. Tesla experienced a sales decline but maintained its market value and advanced AI and autonomy projects. Rivian focused on scaling production and new models, while Lucid worked on stabilizing output amid demand and cost challenges. Despite difficulties, each company pursued long-term growth strategies in a transitioning EV market.