"Assessing Lucid Stock: Is It Time to Buy or Sell?"

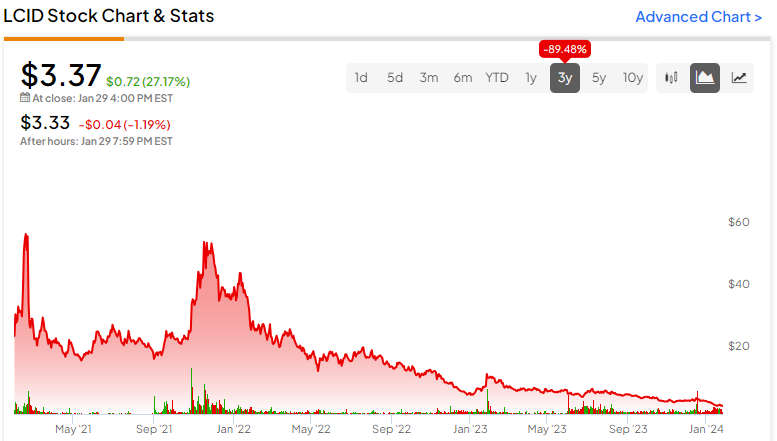

Lucid Group (NASDAQ:LCID) stock has plummeted 95% from its highs, presenting a potential buying opportunity for investors interested in the rapidly expanding electric vehicle market. Despite challenges such as lower-than-expected vehicle deliveries and high cash burn rates, the company is focused on expanding its manufacturing capabilities and vehicle portfolio. However, investors should be prepared for volatility, as Lucid will need to significantly increase production and navigate competition to achieve consistent profitability. With a consensus Hold rating and an average price target of $5.09, Lucid Motors remains a high-risk, high-reward investment worth considering for those willing to weather the uncertainties in the EV industry.

- Down 95% from Highs, Is Lucid Stock (NASDAQ:LCID) a Buy Now? Yahoo Finance

- Could Investing $15,000 in Lucid Stock Make You a Millionaire? The Motley Fool

- Was Lucid Stock Unfairly Punished by the Market Today? Yahoo Finance

- Ma'aden subsidiary to supply high-quality aluminum panels to PIF-backed Lucid Motors Arab News

- Lucid Stock Had Its Best Day in a Year. No One Knows Why. Barron's

Reading Insights

0

8

3 min

vs 4 min read

86%

759 → 103 words

Want the full story? Read the original article

Read on Yahoo Finance