U.S.-China Tech Tensions: Challenges and Strategies in the AI Chip Race

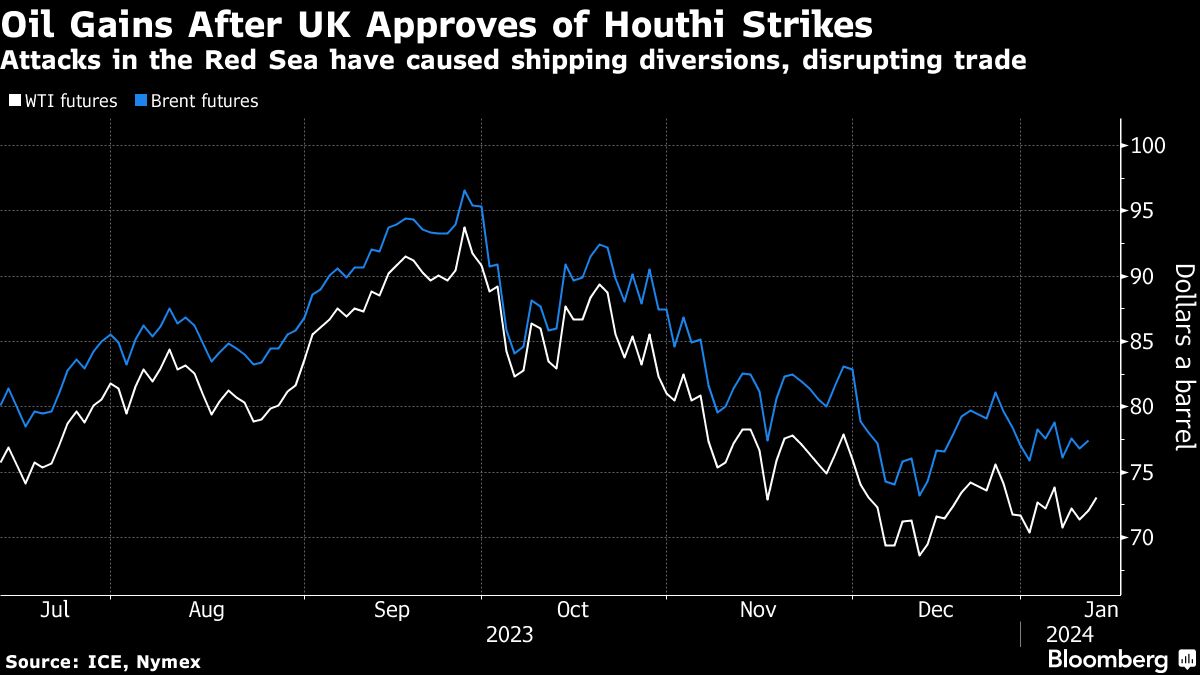

The article discusses the complex and interconnected global oil market, highlighting recent shifts such as increased demand, OPEC+ production cuts, Russia's strategic moves to export oil eastward, and the geopolitical implications for countries like the US, China, and Venezuela, amidst ongoing conflicts and energy transition efforts.