Energy Geopolitics News

The latest energy geopolitics stories, summarized by AI

Featured Energy Geopolitics Stories

Gaza Peace Process: Progress, Challenges, and Resilience

The article discusses the complex and interconnected global oil market, highlighting recent shifts such as OPEC+ production cuts, Russia's continued exports despite sanctions, and the impact of geopolitical tensions on oil prices and energy security. It emphasizes the rising demand, especially from Asia, and the strategic moves by countries like China, India, and Venezuela, while also considering the implications of energy transition policies like the European Green Deal.

More Top Stories

"Geopolitical Tensions in Middle East Drive Oil Price Surge"

OilPrice.com•2 years ago

More Energy Geopolitics Stories

"Middle East Tensions Drive Oil Prices Higher in January"

Oil prices are set for their first monthly gain since September amid escalating tensions between the U.S. and Iran in the Middle East. Despite a recent dip due to China's contracting factory activity, prices have risen on stronger U.S. growth, supply disruptions, and Beijing's economic stimulus efforts. President Biden has indicated a response to the death of U.S. troops, holding Iran responsible and prompting Iran to warn of decisive action in case of U.S. aggression. The potential for a wider conflict raises concerns about crude supplies, with analysts cautioning that a direct confrontation could lead to higher oil prices.

"China Property Crisis Drives Down Oil Prices Amid Middle East Unrest"

Oil prices fell as concerns over China's economic outlook due to the liquidation of property developer China Evergrande overshadowed Middle East tensions following a drone attack that killed U.S. troops in Jordan. The attack, attributed to Iran-backed militants, marked an escalation in the region, adding to existing tensions from the conflict between Israel and Hamas. The situation raises uncertainty about the potential impact on oil demand, with analysts closely monitoring developments in both China and the Middle East.

"Chevron and Aramco CEOs Warn of Real Red Sea Risks to Oil Supply and Prices"

Chevron CEO Michael Wirth expressed concerns about the Houthi attacks in the Red Sea, stating that the situation poses significant risks to oil flows and prices. Chevron, along with competitors Shell and BP, has suspended shipments through the Red Sea due to the attacks. The ongoing conflict has led to a U.S. military response and raised discussions about potentially reversing the foreign terrorist organization label imposed on the Houthis. The situation has also prompted warnings about potential impacts on consumer goods prices and European pocketbooks.

"Chevron CEO Warns of Red Sea Risk to Oil Supply and Price Volatility"

Chevron CEO Michael Wirth warns of the very real risk to oil flows in the Red Sea, with potential for rapid price changes if tensions lead to a major supply disruption in the Middle East. Shell has suspended shipments through the Red Sea, following attacks by Houthi militants. U.S. National Security Advisor Jake Sullivan calls for a unified global response to the Houthi threat, while analysts highlight the potential for a regional conflict to disrupt crude oil flows. Chevron has experienced attacks on its ships by the Iranian Navy, and Iran recently seized an oil tanker in the Gulf of Oman.

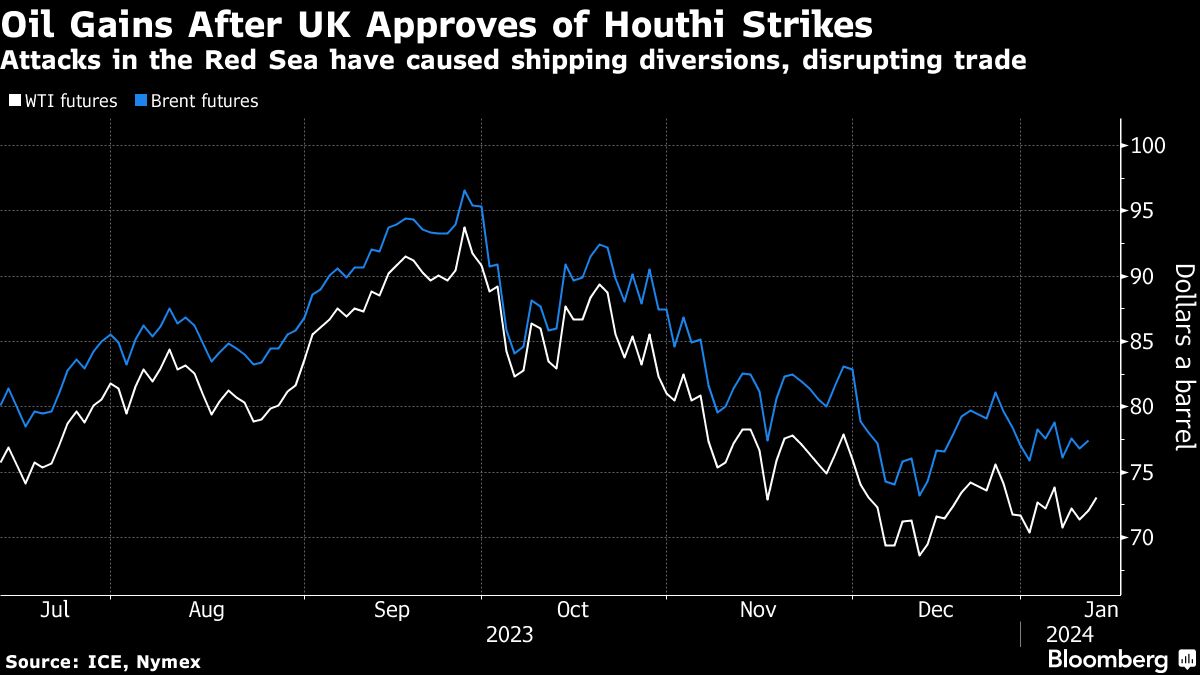

Middle East Strikes Drive Oil Prices Above $80

Oil prices surged above $80 a barrel as the US and its allies launched airstrikes against Houthi rebels in Yemen in response to attacks on ships in the Red Sea, raising concerns about disruptions to oil supply in the region. Tensions have escalated following the recent attacks, with fears of a broader conflict in the Middle East. The situation has prompted commercial shippers to redirect vessels around the southern tip of Africa, impacting oil tanker markets. The possibility of Iran being drawn into the conflict adds to the uncertainty, while the Houthis have vowed to continue their assaults despite the retaliatory strikes.