"Geopolitical Tensions in Middle East Drive Oil Price Surge"

TL;DR Summary

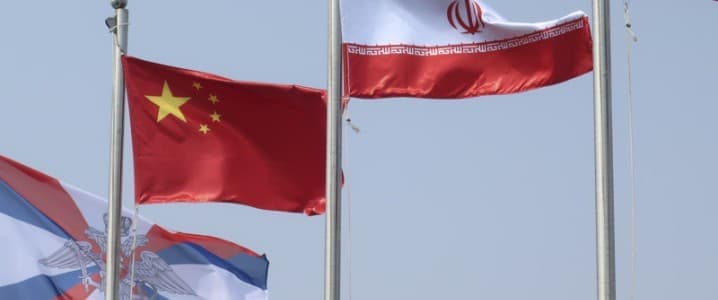

Recent attacks by Iranian proxy forces on U.S. targets and subsequent retaliation have raised concerns about a potential disruption in the global oil market. Iran's oil exports to China, despite sanctions, have been a significant factor in keeping oil prices down. However, the recent escalation in tensions could lead to a removal of this dampening effect, potentially causing oil prices to rise significantly. World Bank estimates suggest a possible increase to around $102 per barrel in the event of a small disruption in oil supply, and a 56-75 percent increase to between $140 and $157 per barrel in the event of a large disruption.

Topics:business#energy-geopolitics#global-energy-market#iran-oil-exports#middle-east#oil-prices#us-iran-relations

- U.S. And Iranian Attacks In The Middle East Threaten Major Oil Price Rises | OilPrice.com OilPrice.com

- Latest Oil Market News and Analysis for Feb. 5 Bloomberg

- Oil prices rise after U.S. retaliatory strikes in Middle East CNBC

- Brent Crude Holds at $77 on Strong Jobs Report, Potential Rate Cut Delay OilPrice.com

- Crude Slumps on Dollar Strength and Reduced Geopolitical Risks Barchart

Reading Insights

Total Reads

0

Unique Readers

1

Time Saved

7 min

vs 8 min read

Condensed

93%

1,429 → 104 words

Want the full story? Read the original article

Read on OilPrice.com