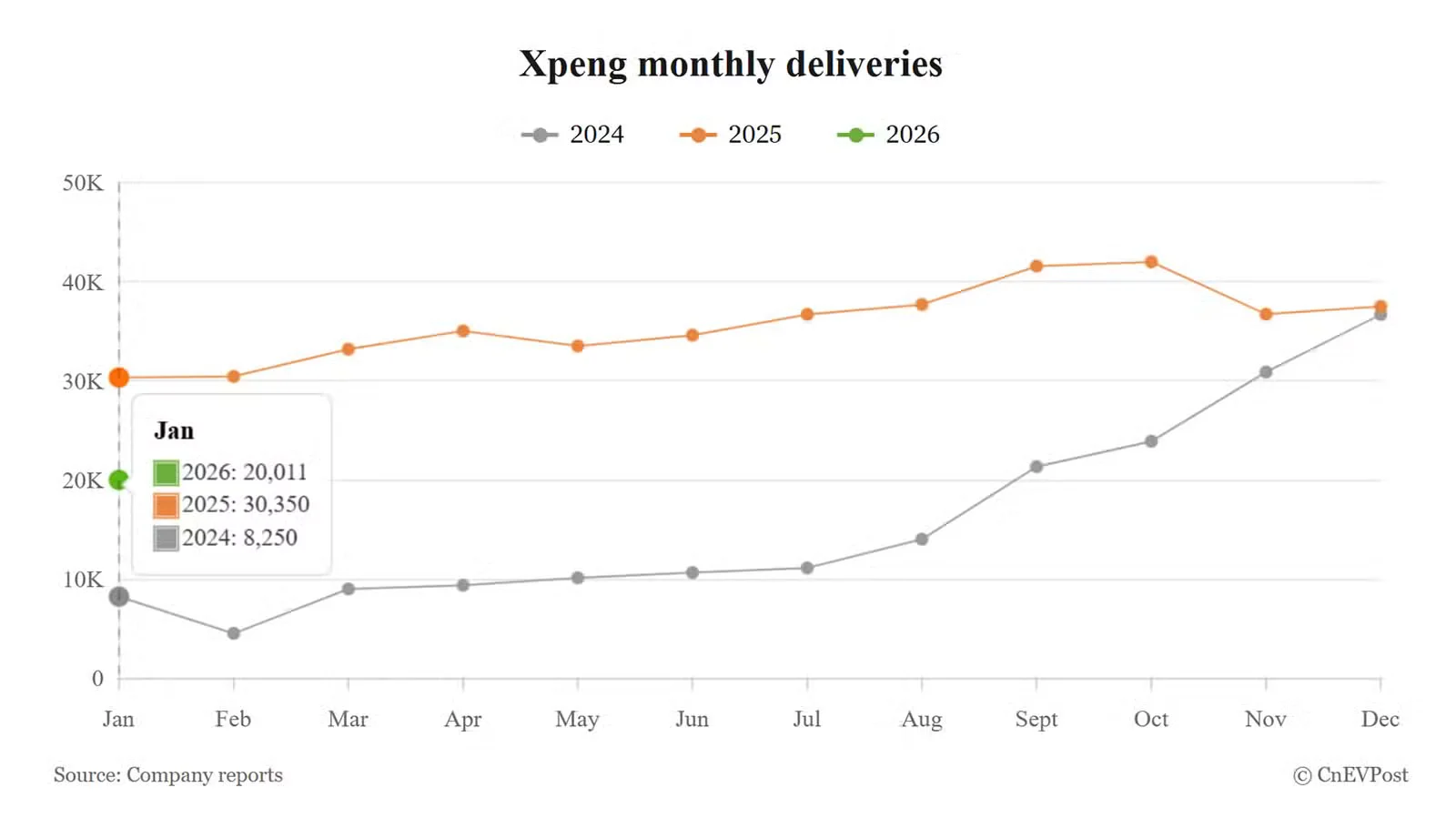

Xpeng's January deliveries slip as tax changes bite

Xpeng delivered 20,011 cars in January 2026, down 34.07% year-on-year and 46.65% month-on-month, pressured by a 5% purchase tax on NEVs and weaker policy support. The X9 MPV continued to sell well with 51,897 cumulative deliveries since its launch. Xpeng targets up to 600,000 deliveries in 2026, plans four new models, and is adjusting financing options amid subsidy changes.