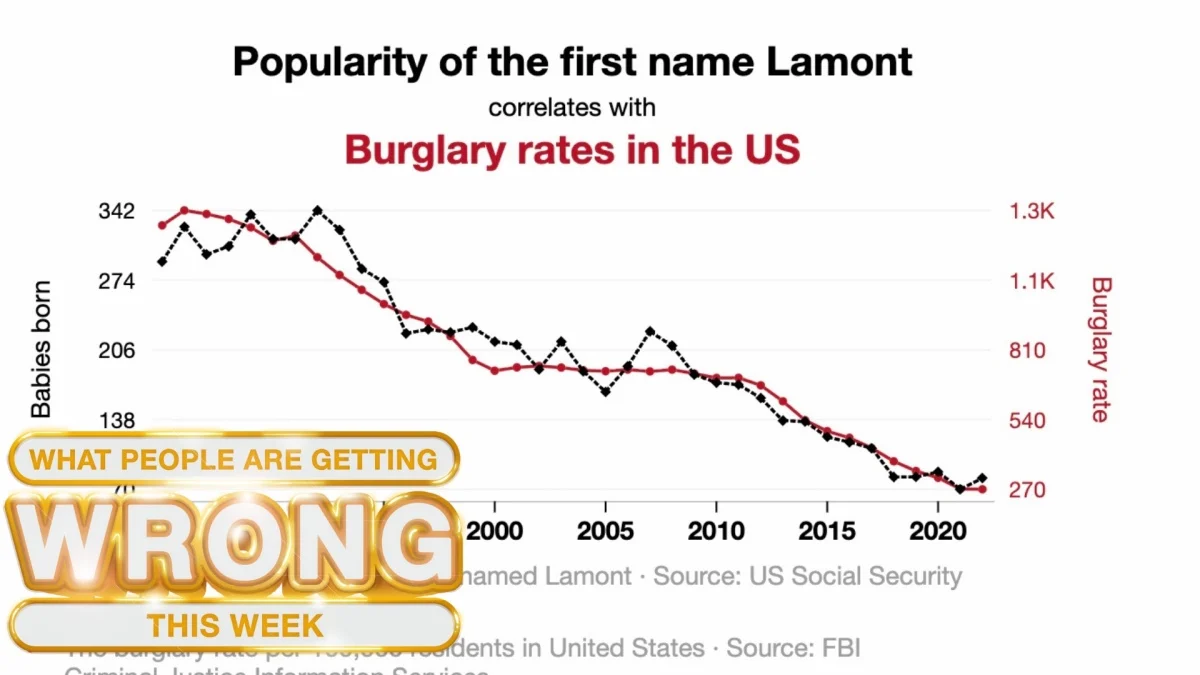

Debunking the Misconception of Correlation and Causation

The article discusses common misunderstandings between correlation and causation, emphasizing the importance of correctly interpreting statistical data to avoid false conclusions.

All articles tagged with #correlation

The article discusses common misunderstandings between correlation and causation, emphasizing the importance of correctly interpreting statistical data to avoid false conclusions.

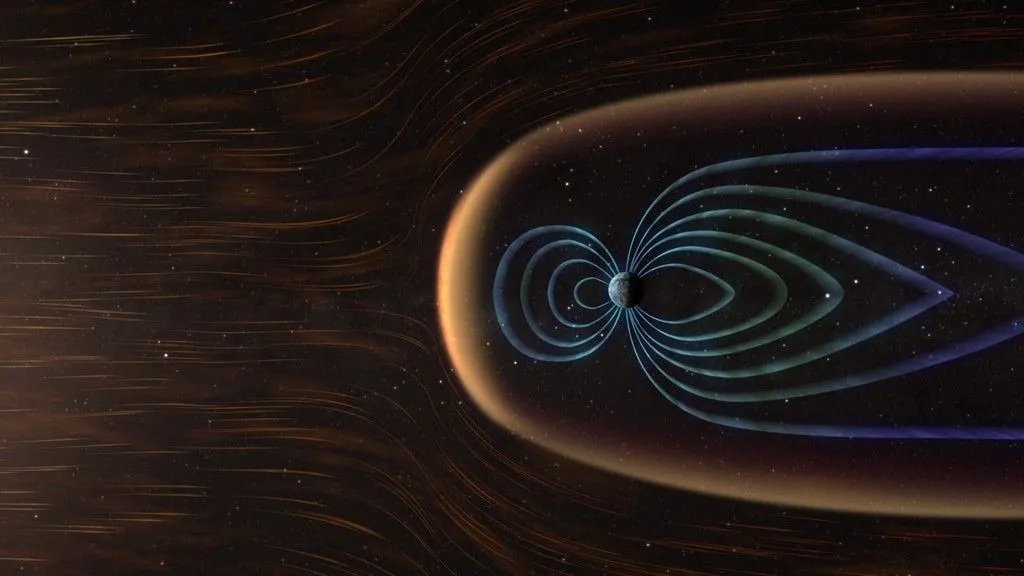

Researchers have found a strong correlation between Earth's magnetic field strength and oxygen levels since the Cambrian explosion, suggesting that core dynamics and mantle interactions may influence both, potentially affecting the evolution of life on Earth.

Cardano (ADA) shows a strong correlation with Avalanche (AVAX) and Polygon (MATIC), with correlation coefficients of 0.99 and 0.98 respectively. Despite recent price declines, on-chain data and market sentiment suggest potential future gains. Negative weighted sentiment indicates low confidence, but could also signal a good accumulation period before a surge. The Market Value to Realize Value (MVRV) ratio suggests these tokens are currently undervalued, hinting at possible price recoveries for ADA, AVAX, and MATIC.

A scientific analysis using data from the Golden Retriever Lifetime Study suggests a potential correlation between canine sterilization and the development of hemangiosarcoma, a deadly cancer. The study found that the likelihood of diagnosing hemangiosarcoma remains low until about eight years of age, after which intact and neutered male dogs face a similar risk. Intact females consistently have a lower probability of diagnosis, while spayed females show an increased likelihood. Further research is needed to explore this correlation and its potential causative factors, which could also provide insights for studying hemangiosarcoma in humans.

The correlation between Bitcoin and Nvidia suggests that BTC could climb as high as $60,000 per coin if Nvidia continues to maintain its momentum in the stock market. Nvidia's leadership role in powering AI models like ChatGPT has contributed to its recent rally in share prices, which has surprised stock market bears by revisiting all-time highs set back in 2021. The correlation between BTCUSD and NVDA goes back a decade, and historically, there is a strong correlation between the two assets. The buzz surrounding AI could be a catalyst for a dot com-like boom in tech stocks, which ultimately would also spill into crypto, adding to the breadth in financial markets.

The consumer price index rose just 0.1% in March, lower than expected, causing Treasury yields to drop. CNBC Pro screened for Nasdaq-100 stocks that are correlated to the iShares 1-3 Year Treasury Bond ETF and found Illumina, Xcel Energy, Seagen, American Electric Power, and Amgen to be the most correlated to falling rates. If inflation falls and short-term rates decline, these stocks could see gains.

The correlation between Bitcoin and stocks has reached its lowest point since 2021, as investors struggle to come to terms with the cryptocurrency's changing narrative. While Bitcoin was once seen as a hedge against inflation and a safe haven asset, it is now being viewed as a speculative investment. This shift in perception has led to a decoupling of Bitcoin from traditional markets, with the cryptocurrency's price movements becoming increasingly independent of stock market trends.