Stock Futures Mixed as Markets Brace for Key Inflation Data

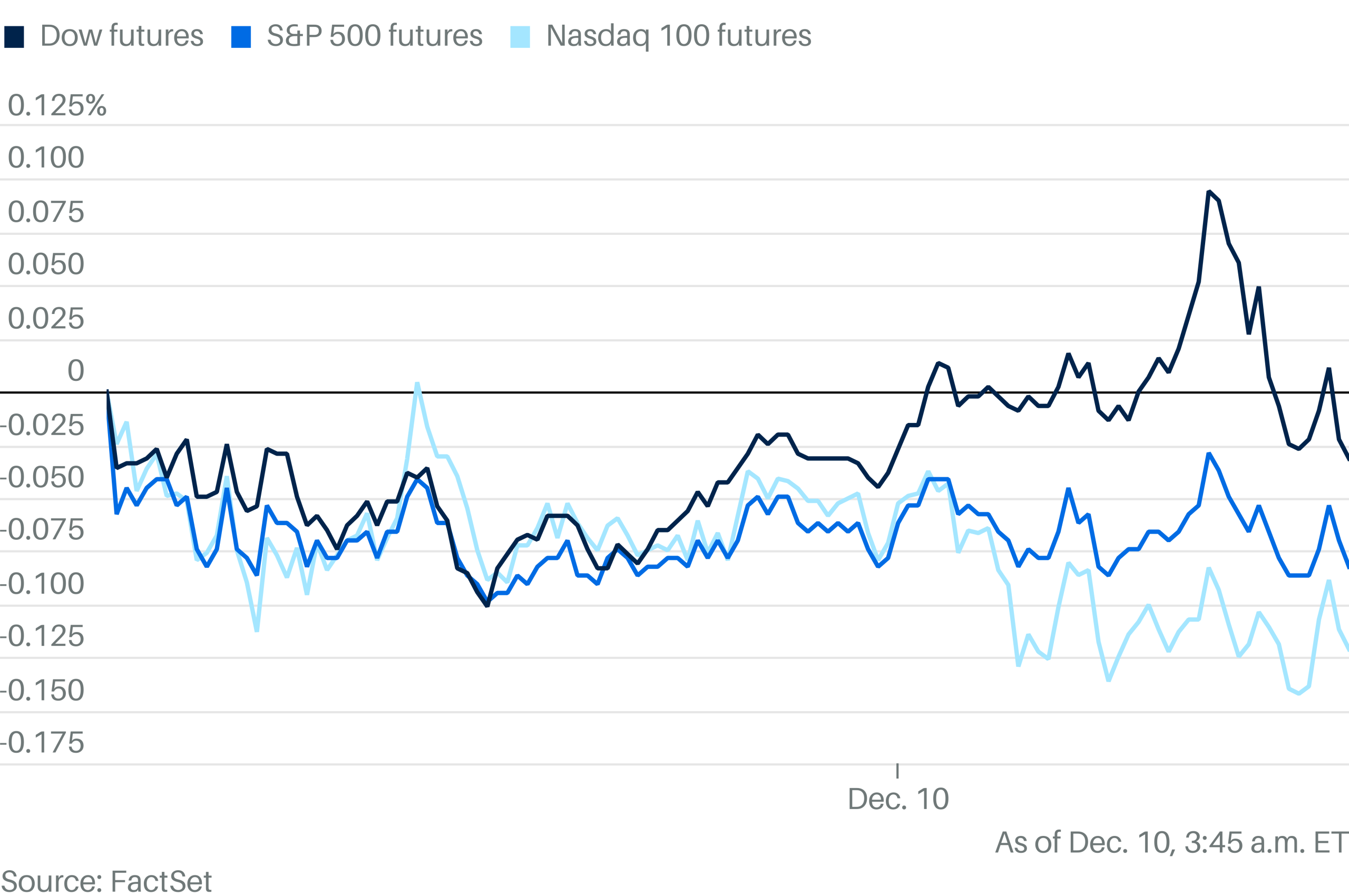

U.S. stock futures were mostly higher as investors awaited the final inflation data of the year, with the S&P 500 and Nasdaq 100 futures slightly up, while Dow futures dipped. The upcoming consumer price index report is expected to show a slight increase in inflation, which could influence Federal Reserve rate cut expectations. Investors are also navigating global geopolitical risks and China's recent antitrust probe into Nvidia, alongside its economic stimulus plans. Despite a recent surge in U.S.-listed Chinese stocks, disappointing trade data from China poses challenges.