The Role of CBDCs in Breaking Financial Barriers and Improving Inclusion

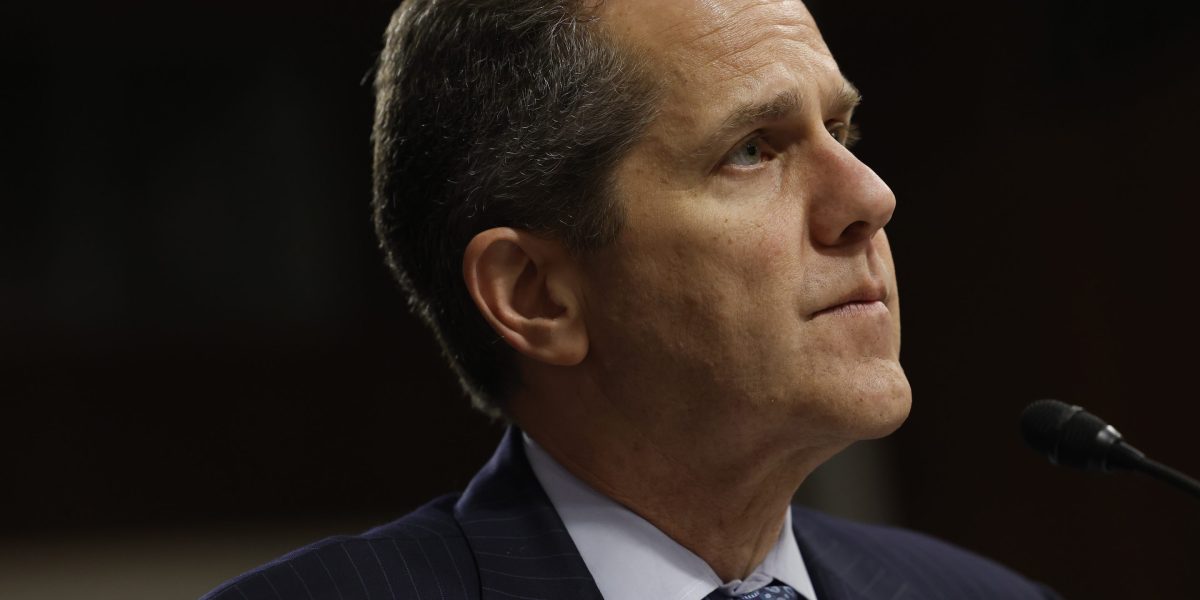

James Wallis, Ripple's VP for central bank engagements and CBDCs, emphasizes the role of central bank digital currencies (CBDCs) in promoting global financial inclusion. Wallis highlights the challenges faced by individuals with low incomes and no ties to financial institutions, such as limited access to credit and financial services. He argues that CBDCs offer a cost-effective solution by providing streamlined payment options and opportunities to establish credit, enabling individuals to build credit histories and stimulate business growth. Ripple is actively collaborating with over 20 central banks on CBDC initiatives and has been recognized for its contributions to digital currency advancement.