Cryptocurrency Regulation News

The latest cryptocurrency regulation stories, summarized by AI

Featured Cryptocurrency Regulation Stories

Ethereum ETFs Signal Major Shift in Crypto Landscape

The SEC's approval of spot Ethereum ETFs may signal a shift in regulatory oversight from the SEC to the CFTC, potentially classifying Ethereum as a commodity rather than a security. This move could undermine the SEC's ongoing crypto crackdown and influence pending lawsuits against major crypto platforms like Coinbase and Kraken. The decision may lead to less stringent regulation under the CFTC, fostering innovation and providing greater legal clarity in the digital asset sector.

More Top Stories

House Blocks Federal Digital Dollar Initiative

AMBCrypto News•1 year ago

"Senate's Push for Stablecoin Regulation Gains Momentum with New Legislation"

AMBCrypto News•1 year ago

More Cryptocurrency Regulation Stories

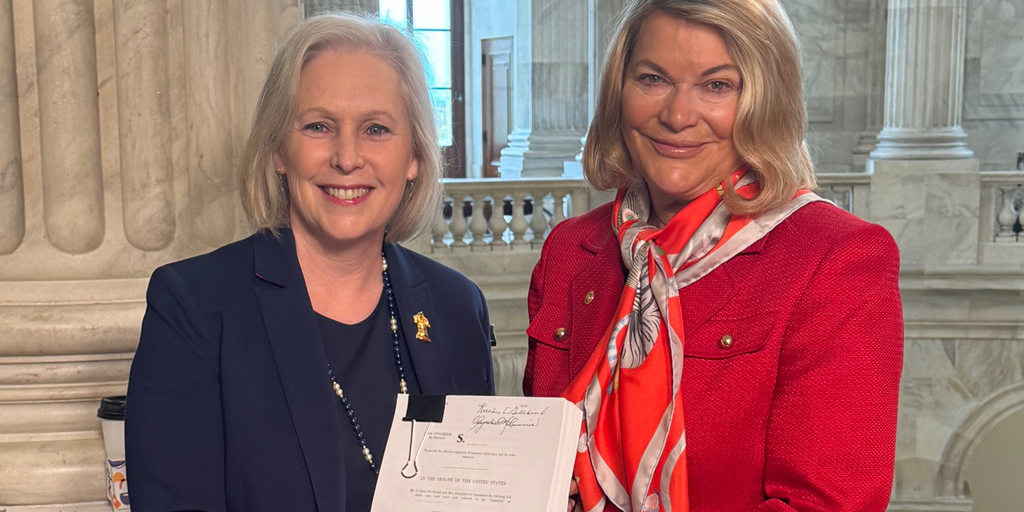

"US Senators Advocate for Comprehensive Stablecoin Regulation"

Senators Cynthia Lummis and Kirsten Gillibrand have introduced a comprehensive stablecoin legislation bill in the US, aiming to establish clear rules for the issuance and regulation of payment stablecoins. The bill includes definitions and rules for firms issuing stablecoins, requiring them to conduct activities through subsidiaries and maintain one-to-one reserves for stablecoins. It also prohibits the issuance of algorithmic stablecoins and places a $10 billion cap on state regulators' supervision of non-depository trust companies in the stablecoin space. The senators are optimistic about the bill's momentum and hope to push it through before election season takes over.

"Coinbase's Appeal Against SEC Ruling: A Critical Move for Crypto Classification"

Coinbase's legal battle with the SEC over the classification of digital assets as "investment contracts" has intensified, highlighting the growing tension between crypto platforms and regulators. The exchange's interlocutory appeal seeks to challenge the SEC's use of the Howey test for cryptocurrency assets, aiming to bring clarity to the regulatory scope of certain transactions. However, a recent ruling dealt a blow to Coinbase's defense, signaling a significant challenge in navigating regulatory scrutiny. The SEC's actions against crypto companies, including Ripple and Uniswap Labs, raise concerns about the agency's impact on the broader crypto-market and its potential threat to cryptocurrencies as a whole.

"Coinbase Appeals U.S. SEC Case to Higher Court"

Coinbase has filed for an interlocutory appeal in federal court to challenge a key legal point in its dispute with the U.S. SEC regarding whether a digital asset transaction not connected to the original issuer should be considered an investment contract. The appeal seeks to clarify the SEC's stance on digital assets and could potentially lead to a U.S. Supreme Court ruling. The SEC argues that most digital assets are securities, while Coinbase and others in the industry contend that once the asset hits secondary markets, it is beyond the SEC's jurisdiction. The outcome of this legal battle could significantly impact the U.S. crypto sector.

SEC Issues Enforcement Notice to Uniswap, Sparking DeFi Industry Backlash

The SEC has served Uniswap Labs with a Wells Notice, signaling a potential lawsuit, prompting the crypto industry to view it as a significant attack on decentralized finance (DeFi). Many in the industry expressed support for Uniswap and its founder, Hayden Adams, while also criticizing SEC Chair Gary Gensler. Some called for clear regulation to enable the crypto industry to thrive in the U.S. rather than seeking success elsewhere.

SEC Sends Wells Notice to Uniswap, Threatening Legal Action

Decentralized exchange Uniswap received a Wells notice from the SEC, signaling a potential enforcement action for acting as an unregistered securities broker and exchange. Uniswap's CEO expressed readiness to fight the charges, while the company argued that tokens it offers are not intrinsically securities. The SEC's move is seen as part of a broader effort to regulate the crypto industry, with Uniswap highlighting the lack of clear regulatory framework and ongoing congressional deadlock.

"SEC Victorious: Coinbase to Face Lawsuit Over Unregistered Securities"

A judge has ruled that the SEC's lawsuit against Coinbase for offering unregistered securities can proceed, stating that Coinbase operates as an exchange, broker, and clearing agency under federal securities laws. The judge rejected arguments from the crypto community that existing laws are inadequate, emphasizing that the challenged transactions fall within the framework used to identify securities for nearly eighty years. However, the SEC's claims against Coinbase's Wallet were dismissed. Coinbase's chief legal officer expressed determination to seek clarity despite the denial of early motions against the government agency.

"SEC Prevails in Lawsuit Against Coinbase, Case to Continue"

A judge ruled in favor of the SEC in its lawsuit against Coinbase, allowing the claim that the cryptocurrency exchange engaged in unregistered sales of securities to proceed to trial. Coinbase's shares fell following the ruling, which rejected its attempt to dismiss the SEC's complaint. The judge agreed with the SEC's allegation that Coinbase's Staking Program involved unregistered securities, but dismissed the claim that the company acted as an unregistered broker through its Wallet application. Coinbase responded by expressing readiness to uncover more about the SEC's internal views on crypto regulation. This development comes as Coinbase plays a larger role in Wall Street's adoption of cryptocurrency, with the SEC recently approving U.S. spot bitcoin exchange-traded funds, many of which have partnered with Coinbase as their custody partner.

"SEC Prevails as Court Rules Against Coinbase in Crypto Lawsuit"

A federal judge ruled against most of Coinbase's motion to dismiss the SEC lawsuit, finding that the regulatory agency had a "plausible" case against the exchange for operating as an unregistered broker, exchange, and clearinghouse. While dismissing claims that Coinbase was acting as a brokerage, the judge allowed other aspects of the suit to proceed, setting an April 19 deadline for the parties to agree on a case scheduling plan. The outcome of this case, along with others, may define how the crypto industry can operate in the U.S., potentially imposing new restrictions and disclosure regulations on trading platforms and limiting the number of tokens available to retail investors.

"Coinbase's Legal Battle with US Securities Regulator"

A federal judge in Manhattan allowed the U.S. securities regulator's lawsuit against Coinbase to proceed, partially granting the company's motion to dismiss the lawsuit. The SEC sued Coinbase in June, alleging that the firm facilitated trading of at least 13 crypto tokens that should have been registered as securities and was operating illegally as a national securities exchange, broker, and clearing agency without registering with the regulator. The decision is a partial win for Coinbase, but largely supports the SEC's approach to cryptocurrency, agreeing with other judges who have sided with the regulator.

GOP Pressures SEC Over Prometheum's Crypto Custody and ETH ETF Delay

House Republicans are pressing SEC Chair Gary Gensler for clarification on the legal treatment of Ethereum (ETH) as a security by Prometheum, a crypto platform planning to offer custodial services for ETH. The lawmakers argue that ETH is not a security and express concerns about the potential impact on the crypto industry. The SEC's stance on ETH's classification remains unclear, and the situation reflects the ongoing regulatory uncertainty surrounding cryptocurrencies in the U.S.