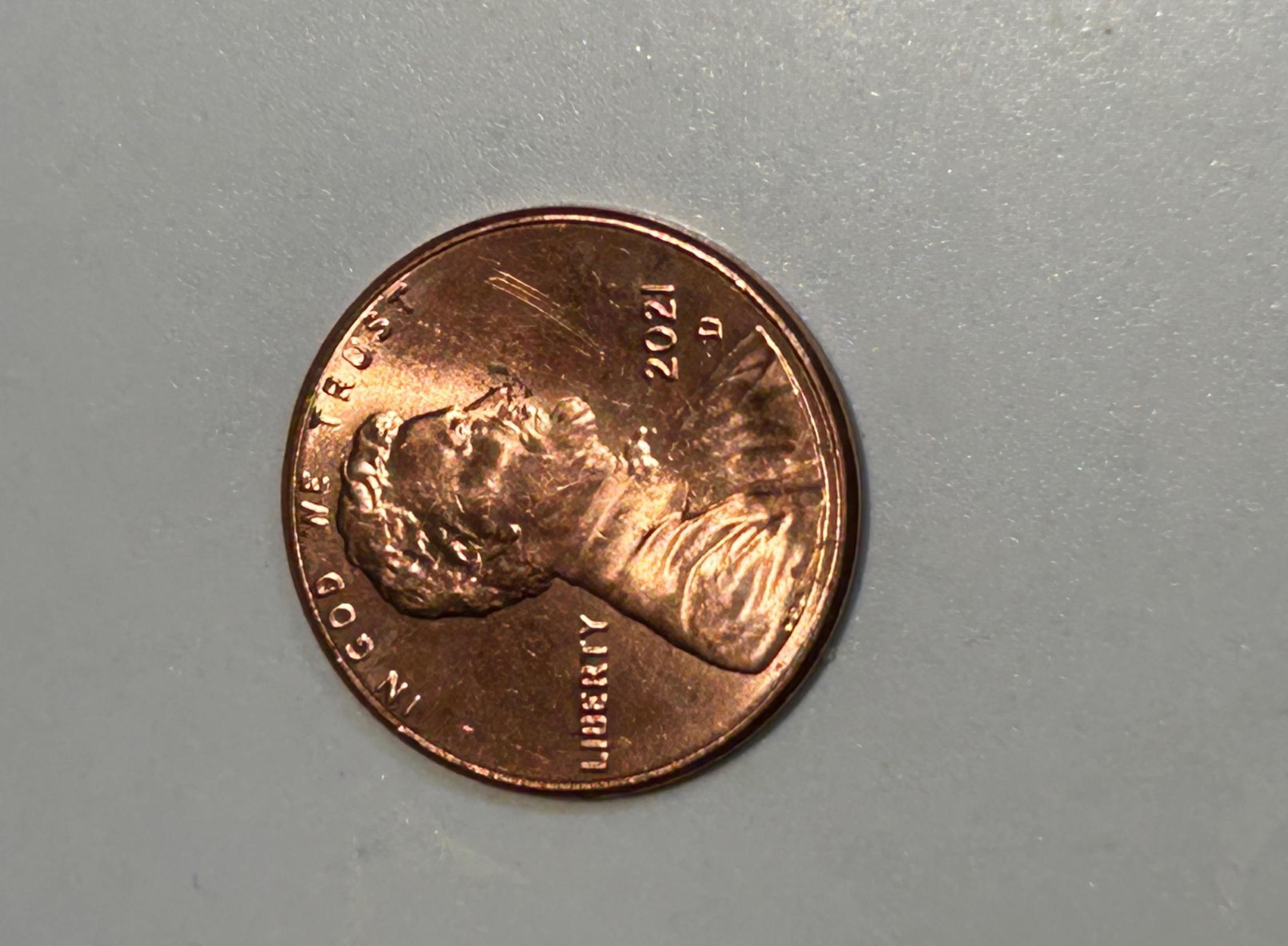

U.S. Penny Shortage Sparks Rounding Debate and Collector Interest

The U.S. Treasury has stopped producing pennies, leading to a shortage and prompting guidance for merchants to round transactions to the nearest five cents, while lawmakers call for legislation to provide legal safe harbors and ensure smooth cash circulation amid ongoing debates about penny recirculation and costs.