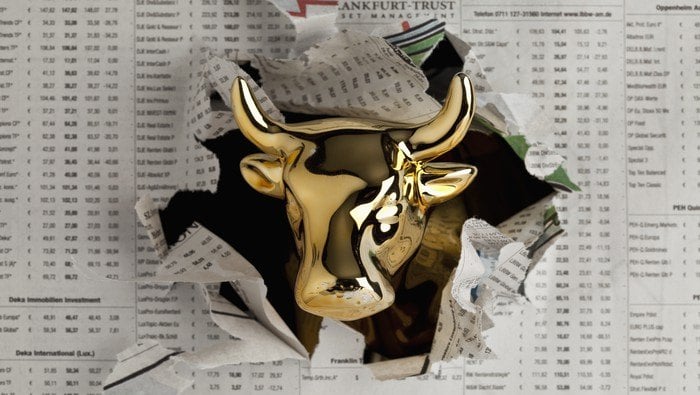

Gold's Record Surge Sparks FOMO and Market Uncertainty

Gold prices are experiencing a record-breaking rally driven by 'Gold-plated FOMO,' highlighting increased investor interest and demand for bullion.

All articles tagged with #bullion

Gold prices are experiencing a record-breaking rally driven by 'Gold-plated FOMO,' highlighting increased investor interest and demand for bullion.

Gold prices reached a record high after reports of U.S. tariffs on bullion, but the White House announced it would clarify misinformation, causing futures to retreat slightly. The tariffs, affecting one-kilogram and 100-ounce gold bars, have added to concerns about market stability amid broader economic uncertainties and existing tariffs on Switzerland.

Gold prices surged near a new record high before pulling back amid escalating tensions in the Middle East, sparked by reports of Israeli strikes on Iranian targets. The uncertainty led to a ripple effect in global markets, with spot bullion initially rising by as much as 1.6% and base metals also experiencing a jump before moderating their gains.

Gold prices have surged to a new record high near $2,430, despite a strong U.S. dollar and hawkish U.S. interest rate expectations. Geopolitical tensions in the Middle East have further boosted gold, but bearish risks are growing due to stretched markets. Possible explanations for gold's ascent include speculative frenzy, hedging against an economic downturn, and betting on a Fed rate cut triggering inflation. Technical analysis suggests support at $2,305 and $2,260, with resistance at the record high of $2,430.

Gold prices hit a new high, surpassing $2,400 an ounce before retreating as investors took profits in the overextended rally, with the precious metal's movement being influenced by economic data and interest-rate expectations. This surge comes as Israel prepares for a potential strike by Iran or its proxies.

Gold reaches a new record high as investors await US inflation data, with economists predicting signs of easing in March. The potential for lower rates from the Federal Reserve makes gold more attractive, despite the lack of a clear trigger for its recent 18% surge. Geopolitical risks and central bank buying have contributed to the metal's bullish momentum, with traders continuing to buy on dips. Spot gold rose to $2,360.35 an ounce, while Treasury 10-year yields climbed to their highest since November in anticipation of the inflation data.

The gold market has experienced a sudden surge, with bullion rising 14% since early March, prompting speculation about the driving forces behind this unprecedented rally. Analysts and industry insiders offer various theories, including central bank concerns about the dollar, anticipation of Federal Reserve rate cuts, algorithmic trading, inflation fears, and geopolitical uncertainty. Despite increased transparency in the market, the surge remains enigmatic, with strong demand for physical gold, rising trading activity in futures and over-the-counter markets, and concentrated buying after key US economic data releases. The surge in gold prices is defying conventional expectations, with investors possibly seeking gold as a haven amid concerns about a potential hard landing in the US economy and geopolitical uncertainty.

Gold experienced a significant pullback of approximately 6% just hours after economist Peter Schiff confidently stated that its rally was real, unlike Bitcoin's. Schiff had predicted a "spectacular crash" for Bitcoin, attributing its recent surge to a speculative frenzy around spot Bitcoin ETFs. However, while gold plummeted from its all-time high of over $2,100, Bitcoin maintained its position around 18-month highs. The initial rally in gold prices was driven by comments from Federal Reserve Chair Jerome Powell, while Bitcoin's surge was fueled by anticipation of a potential spot Bitcoin ETF approval by US regulators.