Bulgaria Withdraws Budget Proposal Amid Massive Protests

The Bulgarian government has withdrawn its budget proposal following the largest protests in a decade, reflecting significant public discontent and political instability.

All articles tagged with #budget proposal

The Bulgarian government has withdrawn its budget proposal following the largest protests in a decade, reflecting significant public discontent and political instability.

France's government proposed cutting two public holidays to boost economic growth, but the plan faces strong opposition from political parties and the public, highlighting the cultural importance of holidays and the political challenges of fiscal reform.

Senator Ted Cruz proposed adding nearly $10 billion to support NASA's space exploration programs, including funding for the Space Launch System, Artemis missions, Mars exploration, and infrastructure improvements, amidst ongoing debates over the administration's budget and legislative support.

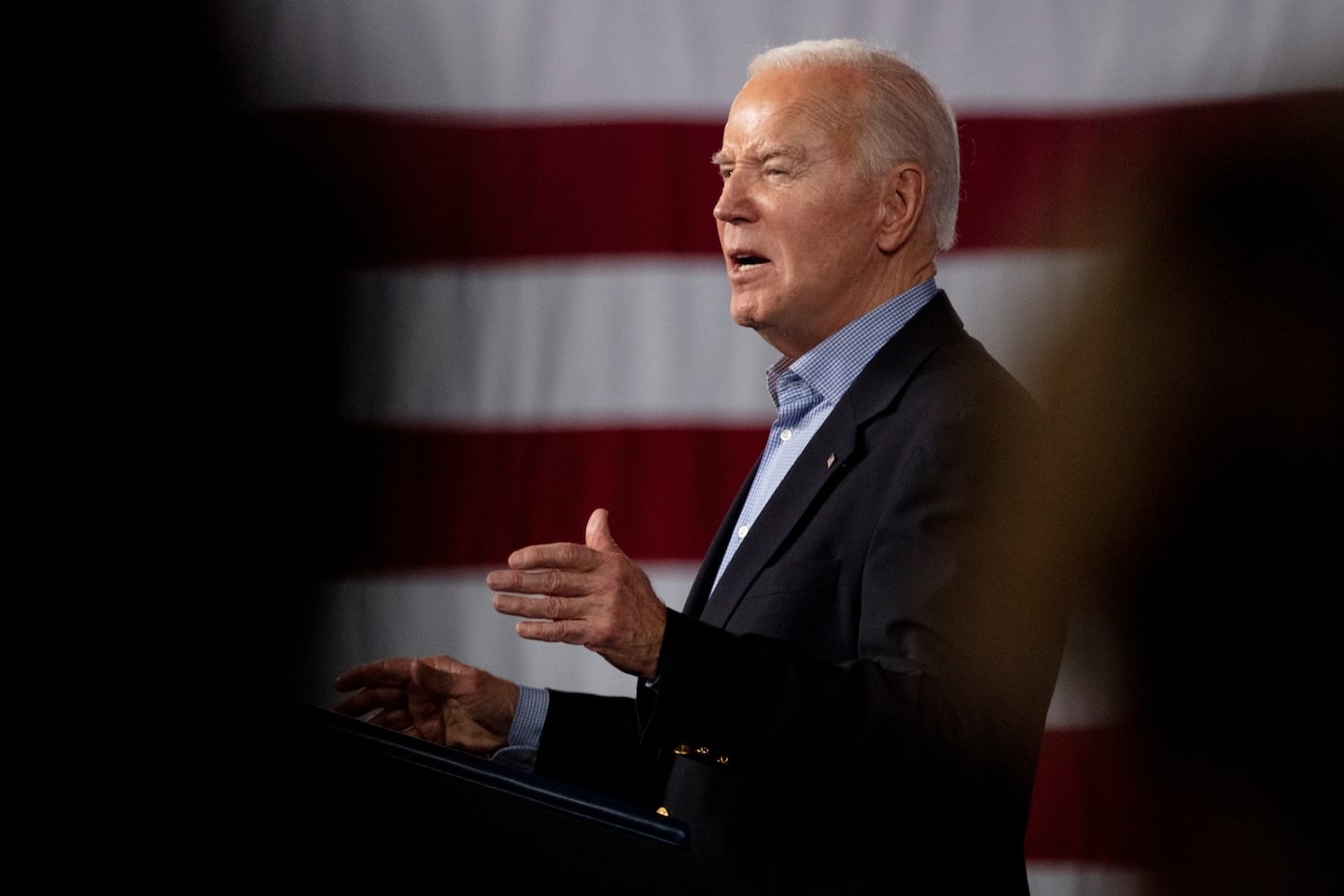

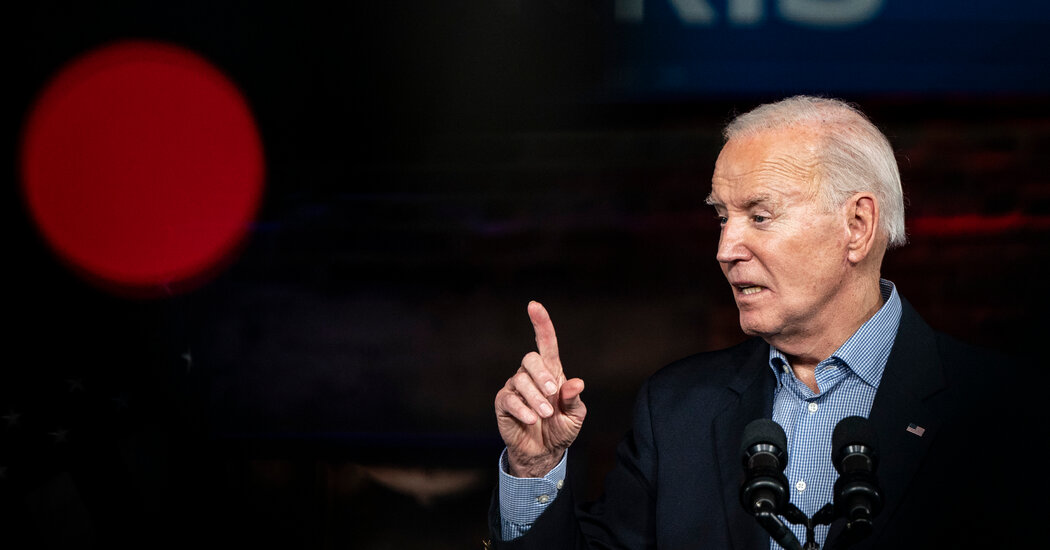

President Biden's budget proposal for fiscal 2025 includes tax breaks for families, lower healthcare costs, and higher taxes on the wealthy and corporations, aiming to reduce deficits by $3 trillion over a decade. The proposal covers various programs, including increased child tax credit, homebuyer tax credit, and down payment aid. It also seeks to help families afford basic needs, address housing shortage, and provide child care access. Biden's plan faces opposition from Republicans, who criticize it as reckless spending, while also highlighting differences in approaches to entitlements and spending cuts.

President Biden's $7.3 trillion budget proposal for the next fiscal year includes tax increases on corporations and high earners, as well as new spending on social programs and efforts to combat high consumer costs. The plan aims to reduce deficits by about $3 trillion over a decade, but faces strong opposition from Republicans who control the House and have passed a budget proposal outlining different priorities. Biden's budget serves as a contrast to former President Trump's economic agenda and is intended to strengthen his position on economic issues with voters ahead of the upcoming election.

President Biden's proposed federal budget for the 2025 fiscal year aims to cut the deficit by $3 trillion over the next decade through tax hikes on corporations and the wealthiest Americans, while introducing new social programs for housing, health care, and child care. The budget also includes measures to protect Medicare and Social Security, allocate billions for border security, and offer cost-cutting measures for struggling families. However, the budget faces opposition from House Republicans and is expected to undergo significant changes during negotiations in Congress.

President Joe Biden unveiled a $7.3tn budget proposal, emphasizing tax breaks for families, lower healthcare costs, and higher taxes on the wealthy and corporations. He criticized his predecessor, Donald Trump, for tax cuts and expanding the federal deficit. Meanwhile, Housing and Urban Development Secretary Marcia Fudge announced her resignation, and Donald Trump's lawyers requested a delay in his New York criminal trial. Additionally, Kansas Republicans faced criticism for an event where attendees beat and kicked a martial arts dummy wearing a Joe Biden mask, and E Jean Carroll may sue Trump again over new attacks.

President Biden unveils a $7.3 trillion budget proposal for fiscal year 2025, featuring major new spending initiatives for health care, child care, and housing, alongside higher taxes on corporations and the wealthy to offset the costs and reduce the national debt. The budget includes universal prekindergarten education, paid family and medical leave, anti-poverty tax credits, and a new tax break for first-time home buyers. While facing opposition from Republicans, Biden's administration aims to build the economy from the middle out and bottom up, with a focus on addressing inflation through investments in affordable child care and eldercare.

President Biden proposed a $7.3 trillion budget for the 2025 fiscal year, emphasizing tax increases on corporations and high earners to support new spending on social programs and combat high consumer costs. The budget includes measures to reduce housing costs, tax cuts for those earning less than $400,000 a year, and aims to reduce deficits by about $3 trillion over the next decade. However, with Republicans controlling the House, the proposal faces significant opposition and is seen as a platform for Biden's re-election campaign.

President Biden is set to release his budget proposal to Congress, including tax and spending policies, as part of his re-election campaign. The proposal includes tax credits for first-time homebuyers and sellers, incentives for homeowners to sell "starter homes," and an expansion of the low income housing tax credit. It also features higher taxes on corporations and the wealthy, an increase in defense spending, and the allowance for Medicare to negotiate prices for prescription drugs.

President Joe Biden's 2025 budget proposal, set to be released, aims to reduce the federal deficit by $3 trillion over the next 10 years through tax hikes on the wealthiest households and reshaping the corporate tax code. The budget also includes plans to shore up Medicare and Social Security, and is seen as a statement of Biden's economic platform for his reelection campaign. Despite a deeply divided Congress, Biden is not diluting his progressive budget requests, and recent polls show a slight improvement in voter sentiments about his handling of the economy.

New Jersey Governor Phil Murphy has proposed an $11.7 billion school funding plan, which could increase school aid in the state by $901 million. The plan would result in 422 districts receiving more state aid, while 137 would see a decrease and 15 would see no change. Governor Murphy stated that the budget proposal aims to ensure students receive a high-quality education for lifelong success.

New Jersey Gov. Phil Murphy has proposed maintaining the ANCHOR property tax benefit at the same payment levels for another year, offering up to $1,750 for homeowners and $700 for renters in his seventh state budget address. Murphy emphasized the program's effectiveness in lowering property taxes and providing financial relief to families, particularly during a time of rising prices.

Illinois Governor J.B. Pritzker has presented a $52.7 billion budget plan that includes over $800 million in tax increases, primarily targeting businesses and sportsbooks, to address a projected deficit and manage the state's pension debt. The proposal also features increased funding for early childhood education, a program to erase medical debt, and support for addressing homelessness and migrant crises. Pritzker's plan has drawn criticism from Republicans for its impact on small businesses and families, but it aims to balance the budget without directly raising taxes or fees on Illinois residents.

Illinois Governor J.B. Pritzker plans to allocate $10 million in federal funds to erase over $1 billion in medical debt for state residents, following the successful model implemented in Cook County. The initiative aims to remove the burden of medical debt for low-income individuals and is set to be the first year of a multiyear plan. The state will partner with the nonprofit RIP Medical Debt to identify and cancel debts for those facing financial hardship, with the potential to benefit 364,000 people in the first year. Additionally, Pritzker's budget proposal includes funding for the ongoing migrant crisis and a tax increase on sports betting revenues, drawing potential opposition from industry lobbyists.