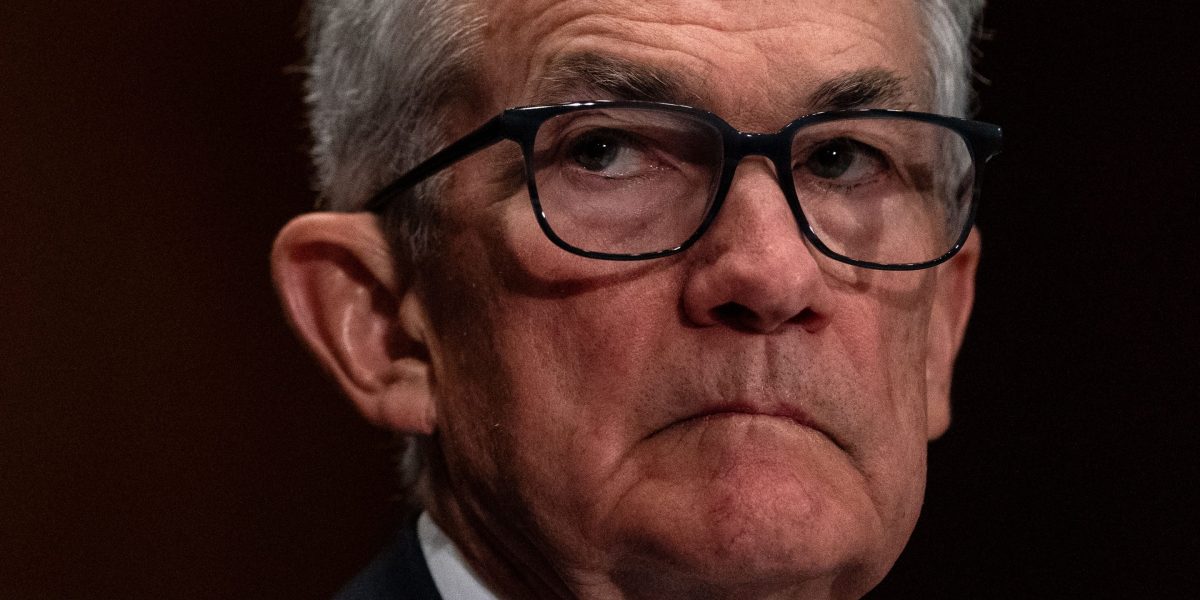

"Powell Foresees Bank Failures Due to Commercial Real Estate Woes"

Federal Reserve Chair Jerome Powell warned that mounting bad commercial real estate loans may lead to some bank failures, but assured that it won't pose a risk to the overall financial system. Powell stated that the Fed is working with lenders to address potential losses and identified banks with high commercial real estate concentrations as particularly at risk. Financial regulators have been closely monitoring the situation, with concerns highlighted by recent troubles at New York Community Bancorp. The non-current rate for non-owner occupied commercial real estate loans has risen to the highest since 2014, prompting the need for monitoring, according to Martin Gruenberg, chair of the Federal Deposit Insurance Corp.

- Powell warns commercial real estate woes will lead to bank failures: ‘This is a problem that we’ll be working on for years’ Fortune

- Powell: 'There will be bank failures' caused by commercial real estate losses The Hill

- Live: Federal Reserve Chair Jerome Powell's Testimony in US House Bloomberg

- Powell Says US Banking System Can Withstand Commercial Real Estate Threats Mint

- Bank ETFs fall as Powell says office market's 'shock to the system' could take years to work through MarketWatch

Reading Insights

0

0

1 min

vs 2 min read

63%

299 → 110 words

Want the full story? Read the original article

Read on Fortune