"Assessing Powell's Impact: Market Reactions and Goldman Sachs Takeaways"

TL;DR Summary

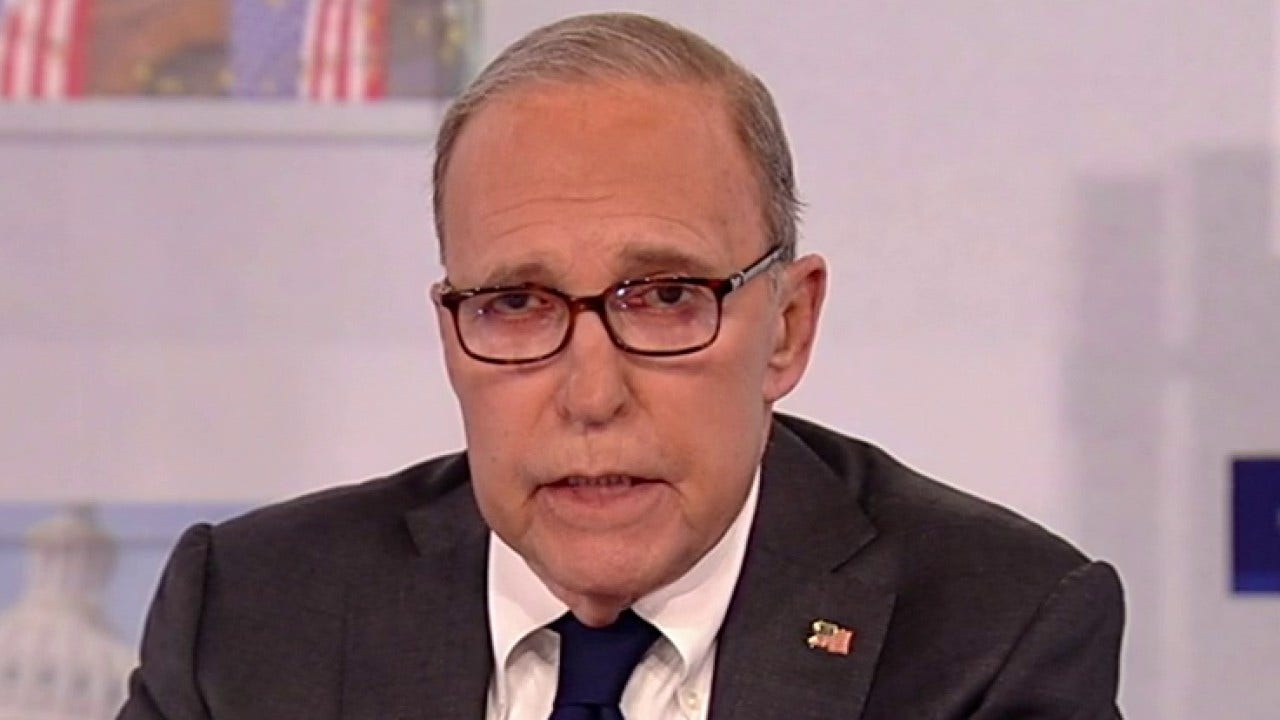

Larry Kudlow discusses the ambiguity surrounding Fed Chair Jay Powell's recent performance and its impact on the stock market. He emphasizes the importance of maintaining the 2% inflation target and cautions against aggressive monetary policies due to rising price-level indicators and personal borrowing costs. Kudlow also highlights former Treasury Secretary Larry Summers' reconstruction of the CPI, revealing higher inflation rates than the official figures. Ultimately, Kudlow supports Powell's cautious approach in light of economic challenges and warns that the economic situation is more complex than official statistics suggest.

- LARRY KUDLOW: Jay Powell is right to keep his pedal off the accelerator Fox Business

- Opinion | Powell on Recent Inflation: 'Are They More Than Bumps?' The Wall Street Journal

- Powell Sidesteps Questions, and Markets Take His Words as Signal to Buy Bloomberg

- Fed Quick Analysis: Powell pummels US Dollar with five dovish comments FXStreet

- Goldman Sachs have 3 three takeaways from Powell's press conference ForexLive

Reading Insights

Total Reads

0

Unique Readers

1

Time Saved

2 min

vs 3 min read

Condensed

84%

538 → 88 words

Want the full story? Read the original article

Read on Fox Business