"Rising Consumer Spending Outpaces Income Amid Inflation Concerns"

TL;DR Summary

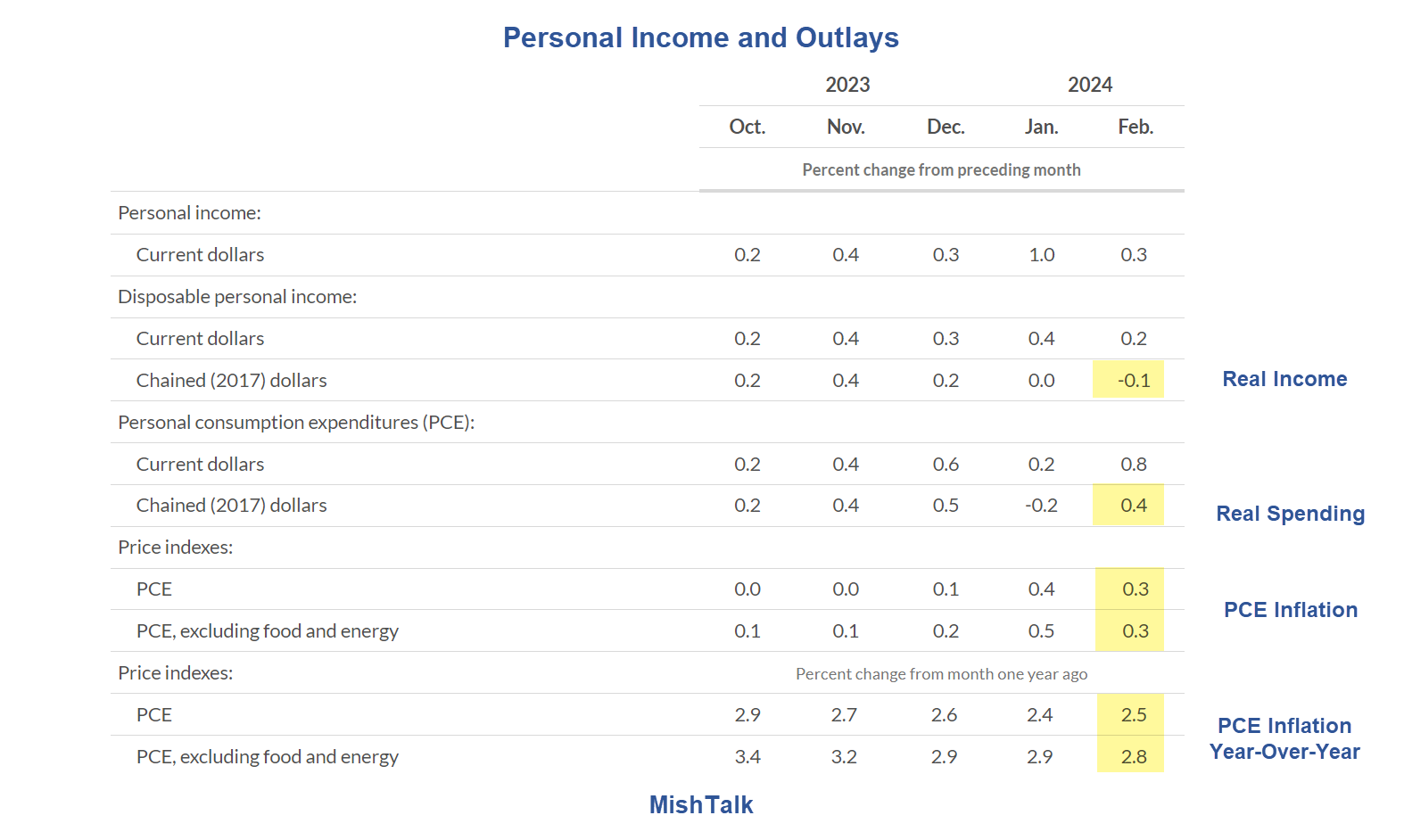

The BEA's report on personal income and spending for February 2024 does not support the need for Fed interest rate cuts, as real income decreased but personal spending surged, and inflation data, particularly the PCE price index, indicates higher inflation than the Fed's target. Additionally, Apartment List reports rent prices have increased for the second consecutive month, and the Case-Shiller National Home Price Index hit a new record high, contributing to the market's expectation of Fed rate cuts despite the data not fully supporting it.

- Spending, Income, and Inflation Data Do Not Support Fed Interest Rate Cuts Mish Talk

- Americans are YOLO spending more but savings hits lows of Great Recession The Washington Post

- Americans Are Making More Money Than Ever But There's a Catch Newsweek

- Consumer Spending Outpaces Income Growth as Inflation Continues PYMNTS.com

- Never Ending Revenge Spending—'What Is the New Norm?' The Wall Street Journal

Reading Insights

Total Reads

0

Unique Readers

1

Time Saved

1 min

vs 2 min read

Condensed

78%

384 → 85 words

Want the full story? Read the original article

Read on Mish Talk