"The Growing Influence of 'Buy Now, Pay Later' on Consumer Spending"

TL;DR Summary

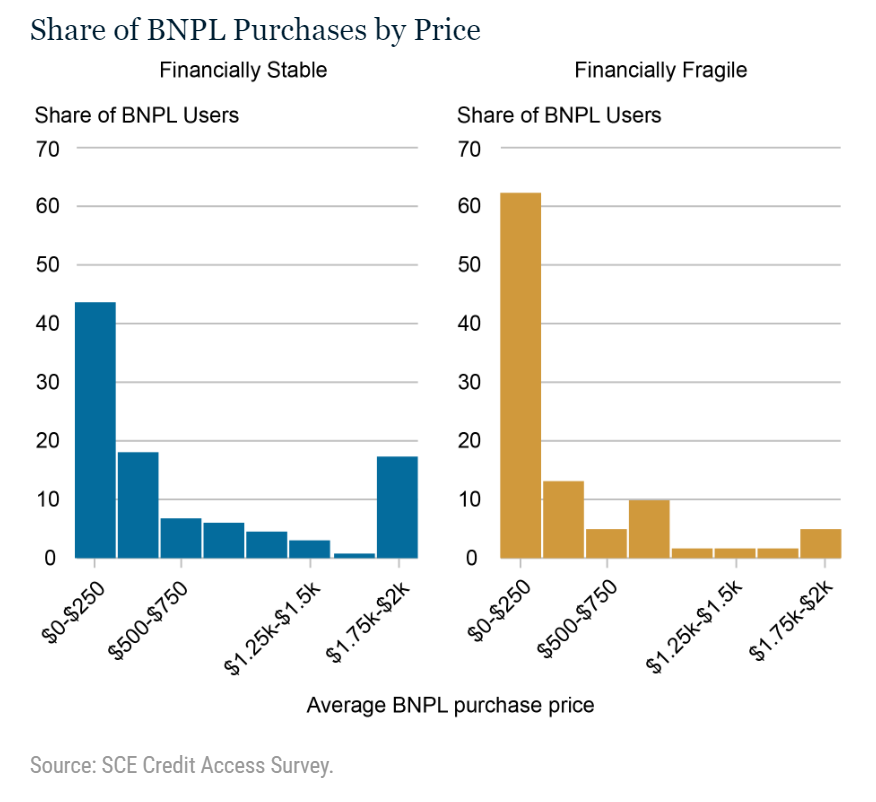

Buy Now Pay Later (BNPL) plans are gaining popularity, particularly among financially fragile individuals, who are more likely to use BNPL at higher frequencies and for medium-size, out-of-budget purchases. The financially stable tend to use BNPL for a few high-priced items to avoid paying interest. However, missing payments can lead to accruing interest, contributing to financial stress and delinquencies, especially among renters facing increasing costs. The study suggests that there is still potential for increased adoption of BNPL, but it also highlights the potential risks and financial implications for users.

- Many Are Addicted to “Buy Now, Pay Later” Plans, It's a Big Trap Mish Talk

- Buy Now, Pay Later now used by one in five shoppers NPR

- Americans with low credit scores use ‘Buy Now, Pay Later’ more often CNN

- How and Why Do Consumers Use “Buy Now, Pay Later”? - Liberty Street Economics Liberty Street Economics -

- How 'Buy Now, Pay Later' Apps Are Changing as They Mature Bloomberg

Reading Insights

Total Reads

0

Unique Readers

1

Time Saved

3 min

vs 4 min read

Condensed

88%

779 → 90 words

Want the full story? Read the original article

Read on Mish Talk