Record-Low Mortgage Rates Spark Surge in New Home Listings

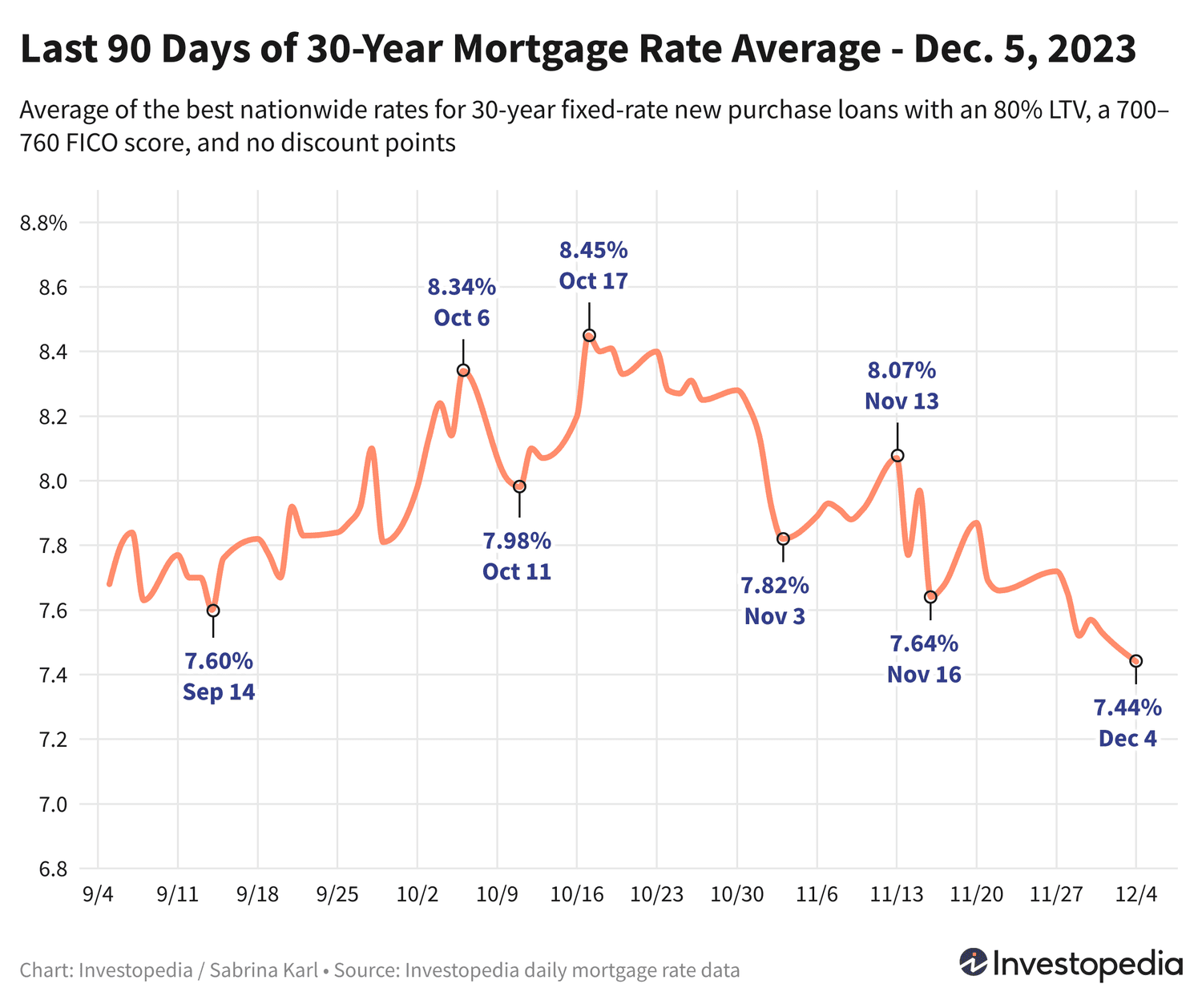

The average 30-year mortgage rate has dropped to its lowest level since August, reaching 7.44%. Other loan averages also decreased, but some remained unchanged and refinancing averages saw multiple increases. It is advised to shop around for the best mortgage option and regularly compare rates from different lenders. The factors influencing mortgage rates include the bond market, Federal Reserve policies, and competition among lenders. The Fed's tapering of bond purchases and rate increases have contributed to the recent upward impact on mortgage rates. However, the Fed has held rates steady in its last two meetings, and future rate increases are uncertain.

- 30-Year Mortgage Rates Drop to Lowest Level Since the Summer Investopedia

- Today’s mortgage interest rates – December 5, 2023 CNN Underscored

- Mortgage Rates Move Slightly Higher, But Still Effectively at 3-Month Lows Mortgage News Daily

- December Mortgage Rate Forecast: Falling and Heading Lower The Killeen Daily Herald

- Hark, New Home Listings Have Finally Arrived—at Lower Mortgage Rates, Too SFGATE

Reading Insights

0

0

5 min

vs 6 min read

91%

1,074 → 101 words

Want the full story? Read the original article

Read on Investopedia