"March Job Growth and Inflation Trends: Impact on the US Economy and Stock Market"

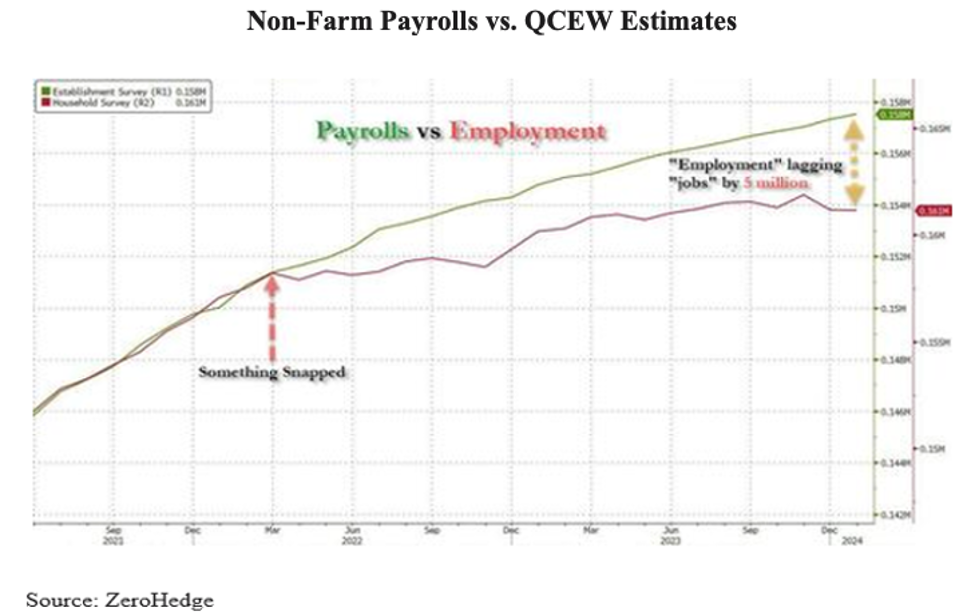

The recent employment report, while seemingly strong, has underlying issues such as disappearing full-time jobs and discrepancies between Non-Farm Payrolls and Quarterly Census of Employment and Wages data, raising questions about its reliability. Additionally, a looming commercial real estate (CRE) and banking crisis is anticipated due to rising loan delinquencies and negative equity in CRE loans, potentially leading to capital issues in the banking system. Despite the Federal Reserve's indication of higher interest rates, concerns about inflation are moderated by falling rents, prompting calls for earlier and more rapid rate cuts to address the impending challenges.

- Employment Numbers Mislead, The Coming Banking Crisis, And Why Inflation Will Moderate Forbes

- US economy has Wall Street 'borderline speechless' after blowout March jobs report Yahoo Finance

- Job growth zoomed in March as payrolls jumped by 303,000 and unemployment dropped to 3.8% CNBC

- Brisk Hiring Bolsters Fed's Cautious Stance on Rate Cuts The Wall Street Journal

- Stock Market Will Feel a Tremor if Payrolls and Inflation Keep Rising Barron's

Reading Insights

0

0

7 min

vs 8 min read

94%

1,493 → 96 words

Want the full story? Read the original article

Read on Forbes