Investors Hesitant to Sell Stocks for Bonds Despite Low Interest Rates

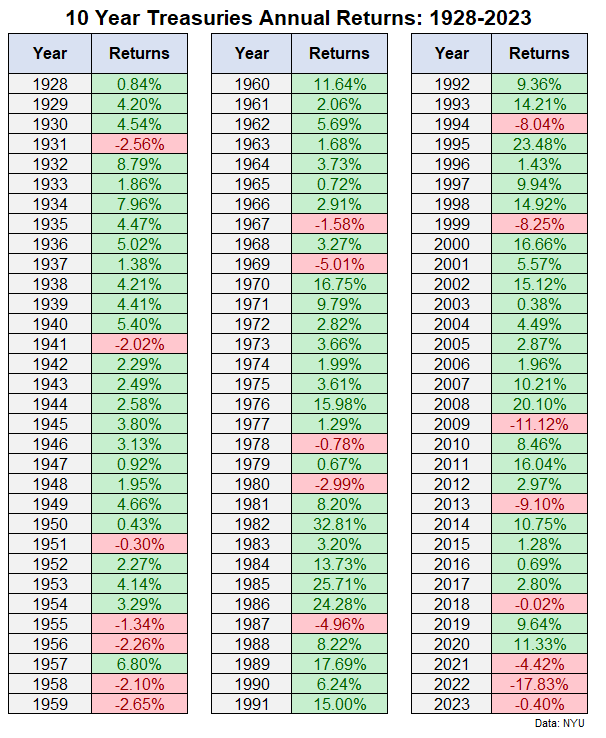

Despite bonds offering more attractive yields, investors are still allocating significant amounts of money to equities. This is because stocks have been performing well while bonds have experienced losses, particularly in the long-duration bond market. Investors have become conditioned to buying or holding stocks after they have fallen, as history has shown that stocks tend to recover. However, the bond market has not seen a similar pattern, and if interest rates continue to rise, there could be an unprecedented run of losses. Bond yields are currently at their highest levels in years, making them appealing for income-seeking investors, but the pain of bond losses may deter investors from shifting their portfolios from stocks to bonds.

- Why Aren't Investors Selling Stocks to Buy Bonds? A Wealth of Common Sense

- Why You Should Consider Buying Treasury Bonds Now | investing.com Investing.com

- Companies don't expect interest rates to fall any time soon Financial Times

- View Full Coverage on Google News

Reading Insights

0

1

3 min

vs 4 min read

82%

650 → 115 words

Want the full story? Read the original article

Read on A Wealth of Common Sense