FDIC imposes multi-billion dollar fees on big US banks for bank failure fund.

TL;DR Summary

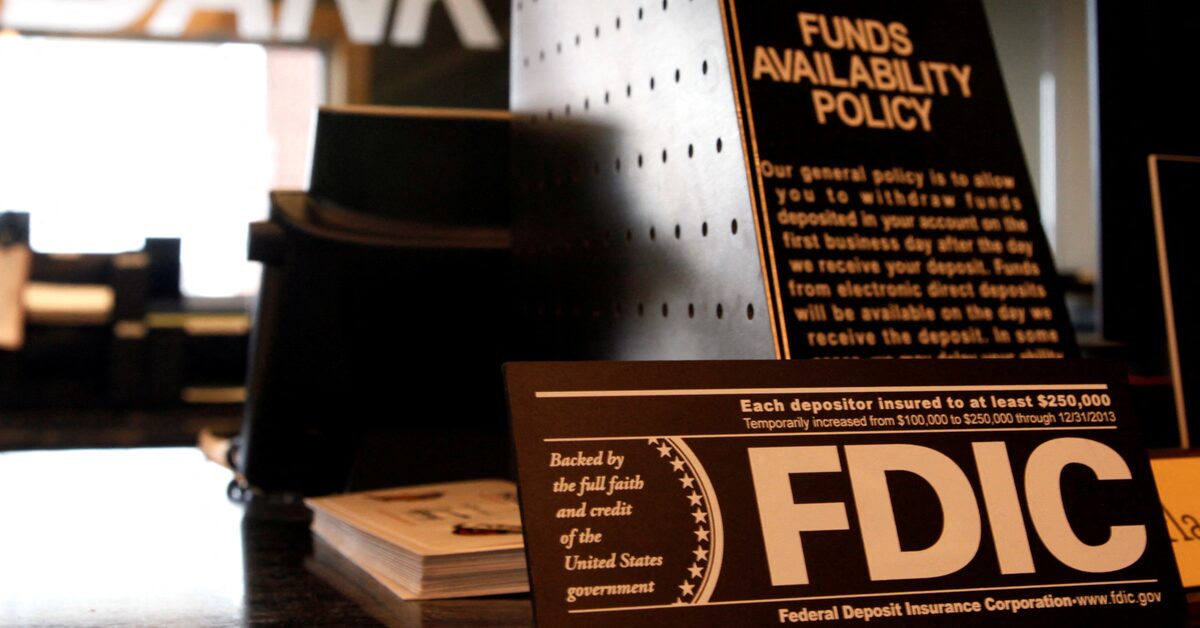

The Federal Deposit Insurance Corporation (FDIC) will apply a "special assessment" fee of 0.125% to the uninsured deposits of lenders in excess of $5 billion to replenish the $16 billion hit to a key deposit insurance fund caused by recent bank failures. The fee applies to all banks, but in practice, it would affect lenders with more than $50 billion in assets, which would cover over 95% of the cost. Banks with less than $5 billion in assets would not pay any fee. The levy would be collected over eight quarters beginning in June 2024.

- Big U.S. lenders to pay billions to replenish bank failure fund Reuters

- FDIC wants banks bigger than $5B to pay for SVB and Signature failures Yahoo Finance

- FDIC proposes plan to recover losses to deposit insurance fund CNBC Television

- Big banks could face billions more in FDIC fees after bank collapses CNN

- FDIC to hit biggest US banks with $16bn bill for SVB clean-up Financial Times

Reading Insights

Total Reads

0

Unique Readers

8

Time Saved

3 min

vs 4 min read

Condensed

84%

608 → 95 words

Want the full story? Read the original article

Read on Reuters