The Impending Economic Downturn: Bankruptcies, Debt Defaults, and Retail Investors

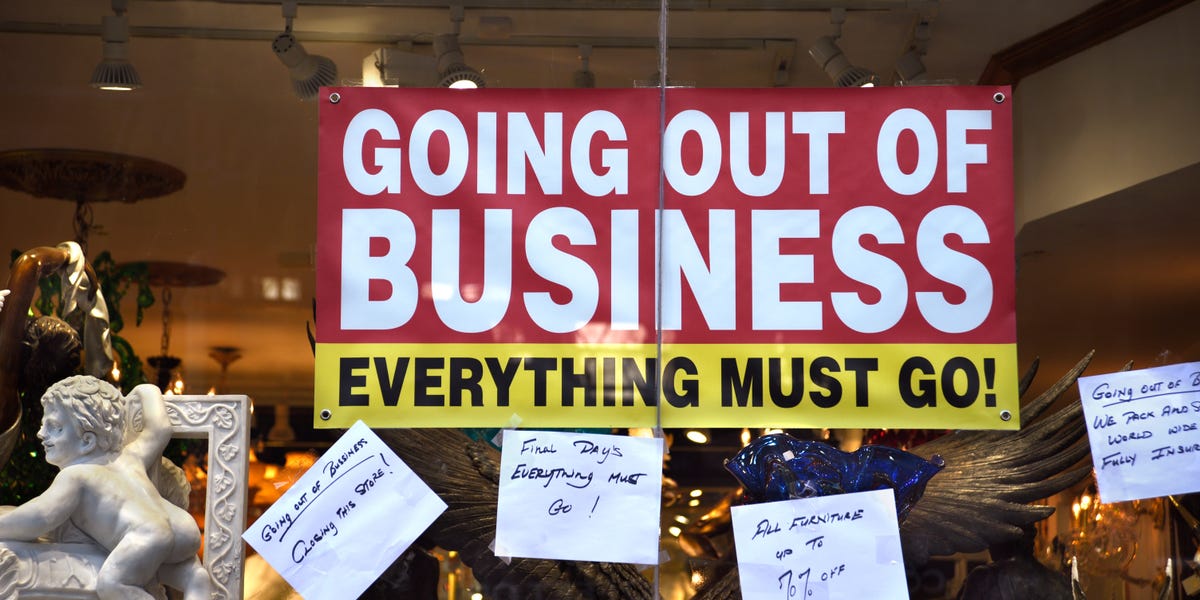

A wave of corporate bankruptcies and debt defaults is expected to hit the economy, with experts warning that it could lead to a recession. The number of bankruptcy filings has already surpassed the total for 2021 and 2022, and global corporate debt defaults are also on the rise. Higher interest rates are taking a toll on businesses and consumers, with borrowing costs for some firms doubling or nearly tripling compared to previous years. This is particularly challenging for "zombie firms" that don't have the cash to service their debt. The increase in defaults and bankruptcies could result in job cuts, negatively impact asset prices, and slow down the economy. Other factors, such as consumers depleting their pandemic savings, the restart of student loan payments, and rising bond yields, are also signaling a potential economic slowdown.

- Wave of Bankruptcies, Corporate Debt Defaults Could Spark a Downturn Markets Insider

- Fading Optimism on Rates Signals Trouble Ahead for $425 Billion Debt Wall Yahoo Finance

- How corporate bonds can reach retail investors | Mint Mint

- Here's Why You Don't Bet Against the American Consumer Markets Insider

- Finance chiefs are switching from cash-flow to asset-based loans Greater Baton Rouge Business Report

Reading Insights

0

5

3 min

vs 4 min read

82%

744 → 135 words

Want the full story? Read the original article

Read on Markets Insider