Economists Criticize Fed's Handling of Weakening Economy and Inflation

TL;DR Summary

Recent softening economic data has led markets to anticipate that the Federal Reserve may cut interest rates, with experts like Jeremy Siegel expecting a 0.25% reduction in September and further cuts in 2025, as the economy shows signs of slowing without collapsing, prompting a shift in monetary policy outlook.

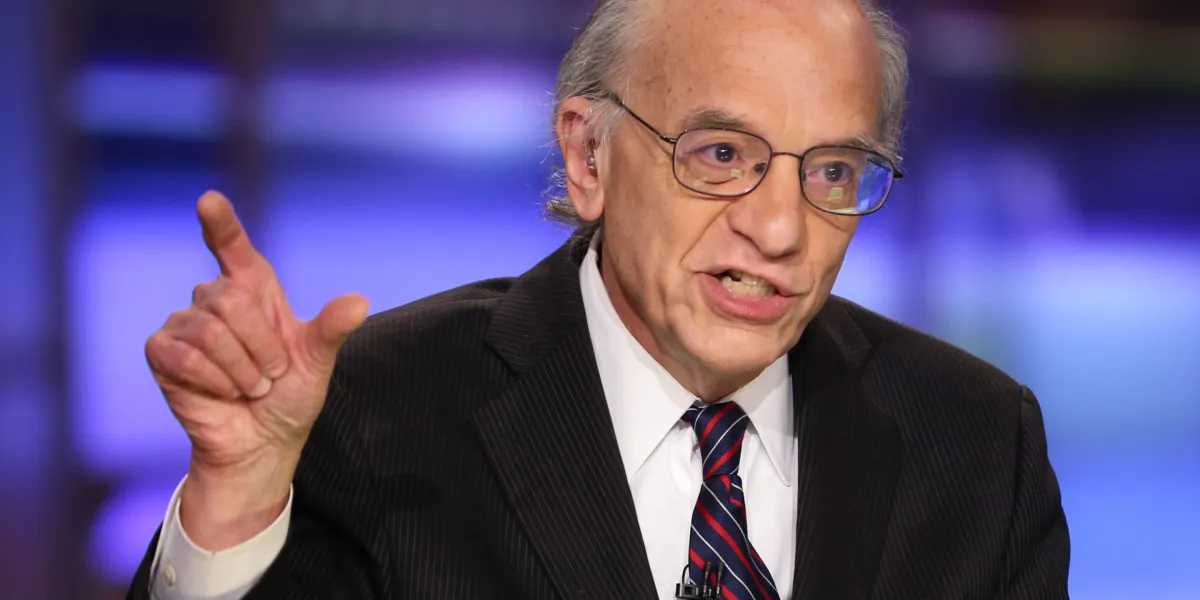

- Sorry Jerome, weakening economic data is 'exactly what markets needed', says Wharton professor Fortune

- The Fed got it wrong and is late again, top economist says, as job gains collapse Fortune

- Billionaire Chamath Palihapitiya Says Fed Destined To Be Wrong Again in 2025, Warns of Economic Disruptions The Daily Hodl

- The Fed caused high inflation and the current jobs slump. Blog de Daniel Lacalle

- Economist Asks Fed To Take Its 'Head Out Of The Sand' On Rates Amid Weak Jobs Report — But Cuts 'Will Harm the Labor Market,' Says Peter Schiff Benzinga

Reading Insights

Total Reads

0

Unique Readers

2

Time Saved

3 min

vs 4 min read

Condensed

93%

748 → 49 words

Want the full story? Read the original article

Read on Fortune