Bank of Japan's Rate Hike Sparks Yen Decline and Market Reactions

TL;DR Summary

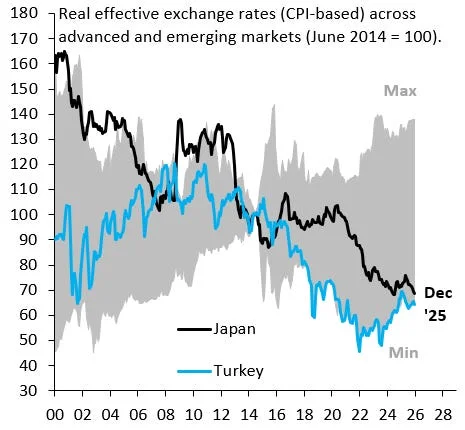

Despite a rate hike by the Bank of Japan, the Yen continues to weaken due to persistently low long-term interest rates driven by Japan's massive public debt and ongoing government bond purchases, leading to a cycle of currency debasement that may only be addressed through fiscal consolidation, which currently lacks political support.

- Japan's Yen Debasement Robin J Brooks | Substack

- Bank of Japan Raises Interest Rates to Highest Level in 30 Years The New York Times

- Nasdaq rallies again while yen falls despite BOJ rate hike Yahoo Finance

- Bitcoin Price Prediction: Can the BTC Price Push Above $90,000 With the Latest BoJ Rate Hikes? Binance

- The Bank of Japan Raised Rates. Here’s Why You Should Care. wsj.com

Reading Insights

Total Reads

0

Unique Readers

3

Time Saved

2 min

vs 2 min read

Condensed

87%

390 → 52 words

Want the full story? Read the original article

Read on Robin J Brooks | Substack