Eurozone Inflation Rises, ECB Rate Cut Still Likely

TL;DR Summary

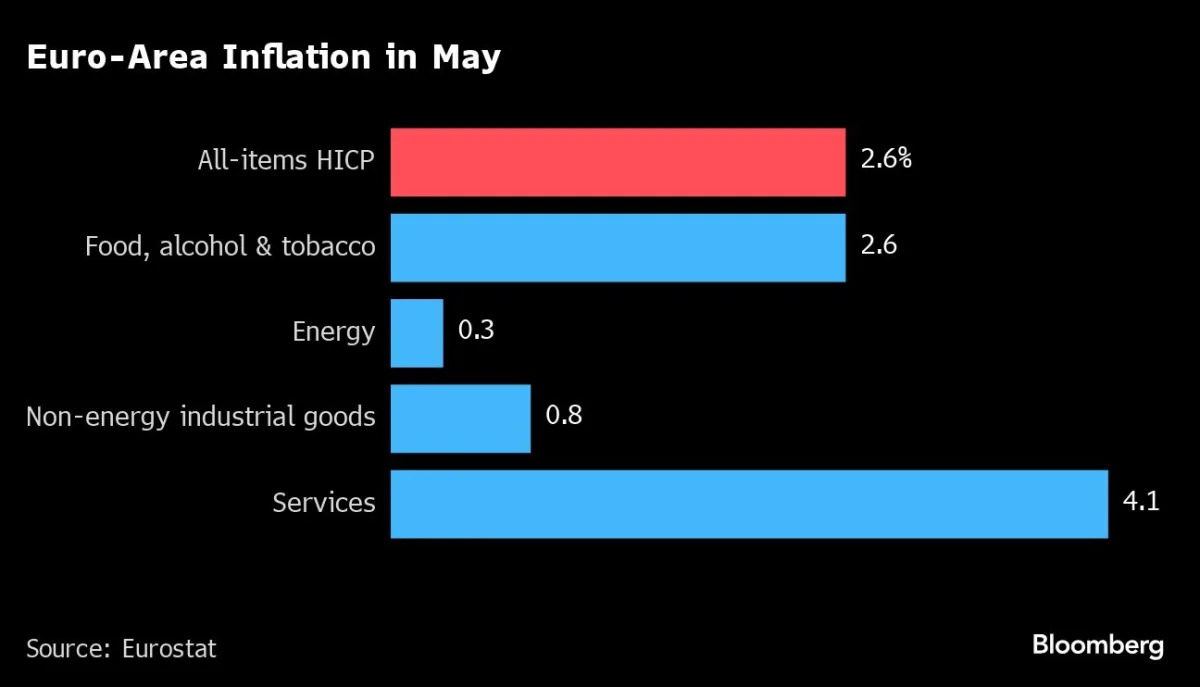

Euro-area inflation rose to 2.6% in May, surpassing expectations and complicating the European Central Bank's (ECB) planned interest rate cut next week. Despite the increase, the ECB is set to reduce the deposit rate from its current 4%, with money markets predicting two cuts this year. The rise in inflation is driven by domestic factors like wages and corporate profits, and the services sector saw a significant jump to 4.1%. ECB officials remain cautious, emphasizing a gradual approach to monetary policy adjustments.

- Euro-Zone inflation up more than expected before ECB cut Yahoo Finance

- Eurozone Inflation Rises as ECB Considers Rate-Cut Path The Wall Street Journal

- Euro zone inflation rises to 2.6% in May, but bloc still seen heading for interest rate cut CNBC

- Uptick in European inflation clouds outlook for interest rate cuts amp.cnn.com

- Inflation ticked up in Europe in May. That likely won't stop a central bank rate cut next week The Associated Press

Reading Insights

Total Reads

0

Unique Readers

1

Time Saved

3 min

vs 4 min read

Condensed

89%

736 → 82 words

Want the full story? Read the original article

Read on Yahoo Finance