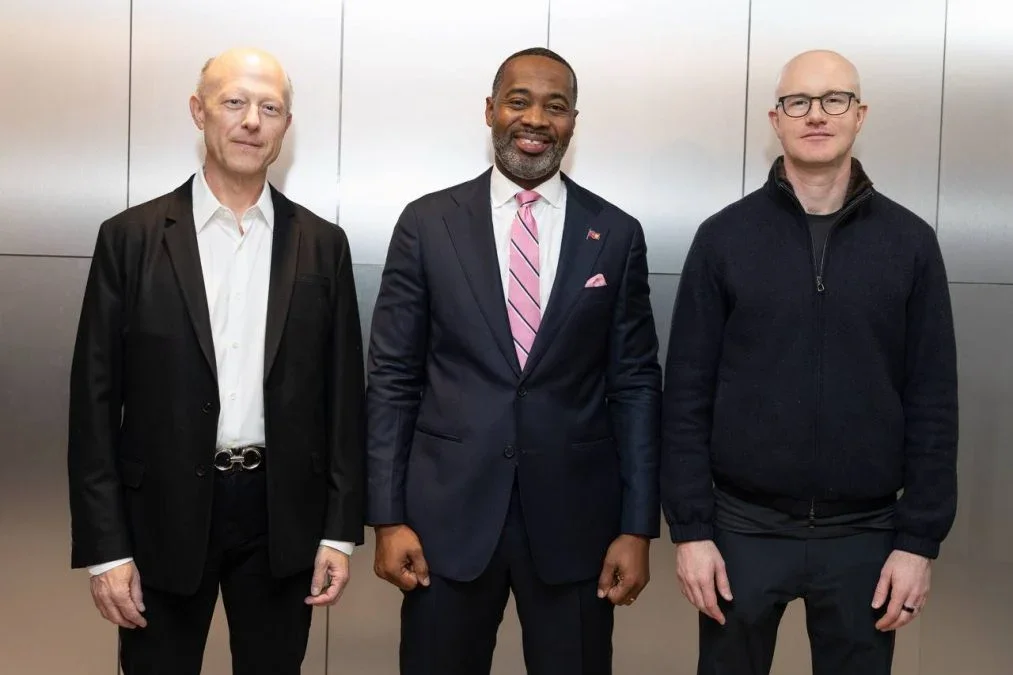

Bermuda bets on a fully on-chain economy with Coinbase and Circle

Bermuda unveiled a plan, announced at Davos, to transform the island into a fully onchain economy by partnering with Coinbase and Circle to deploy digital asset infrastructure across government, banks, businesses, and consumers. The initiative centers on piloting stablecoin payments (USDC), expanding USDC adoption, and supporting tokenization and digital finance education, with a non-exclusive approach that could attract additional technology partners while lowering costs and broadening access to global finance.