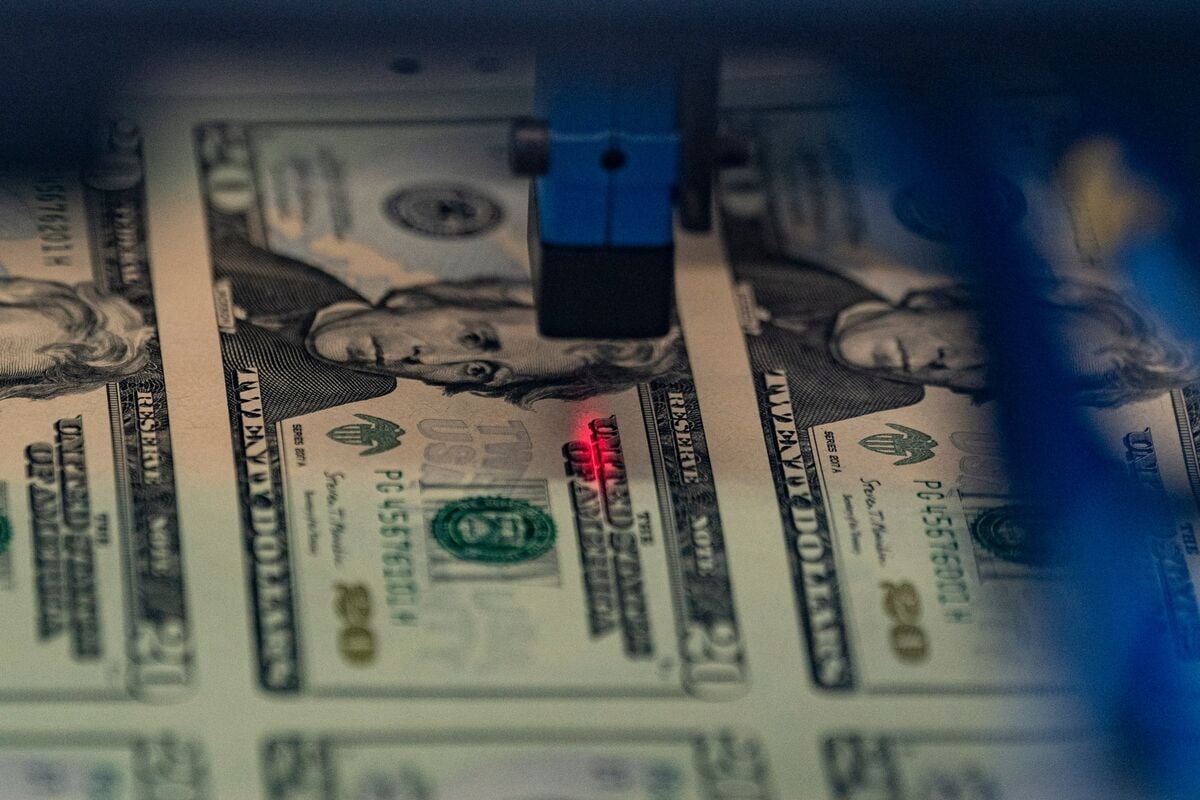

Dollar Slightly Declines Against Yen Amid Data and Central Bank Moves

The US dollar declined against the yen and Swiss franc amid a busy week of central bank decisions and US economic data releases, with expectations of a Bank of Japan rate hike and potential rate changes by the ECB and Bank of England. Key US data, including jobs and inflation reports, are awaited to clarify the Federal Reserve's policy outlook, while cryptocurrencies like Bitcoin and Ether continue to decline.