Uniswap's Price Outlook: Bullish Trends and Resistance Levels to Watch

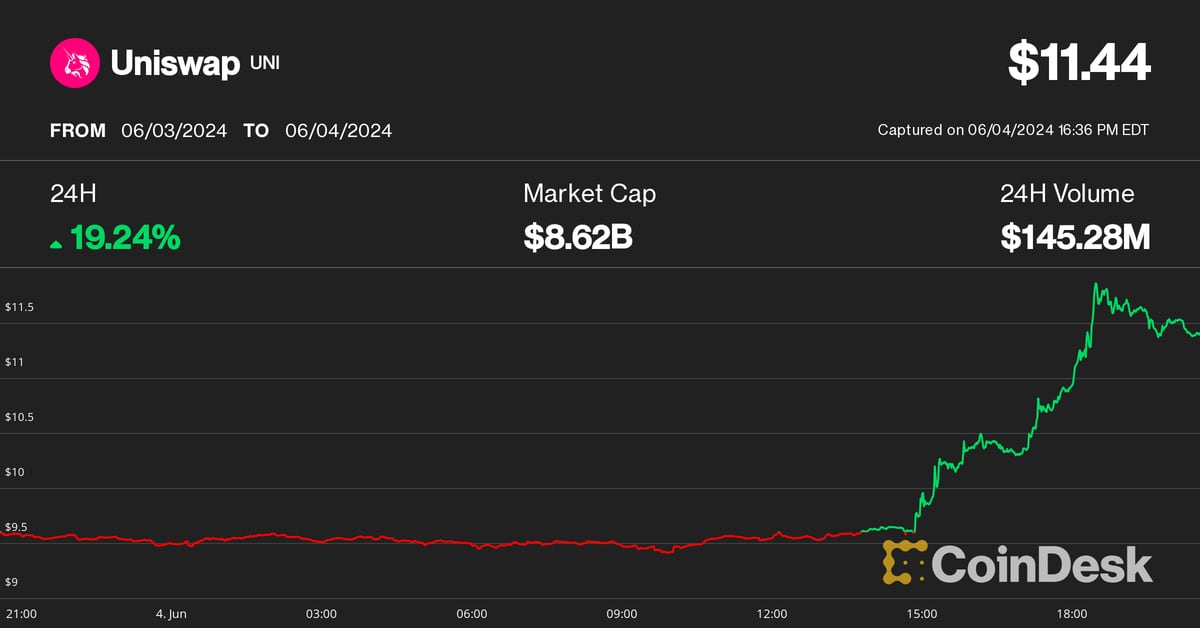

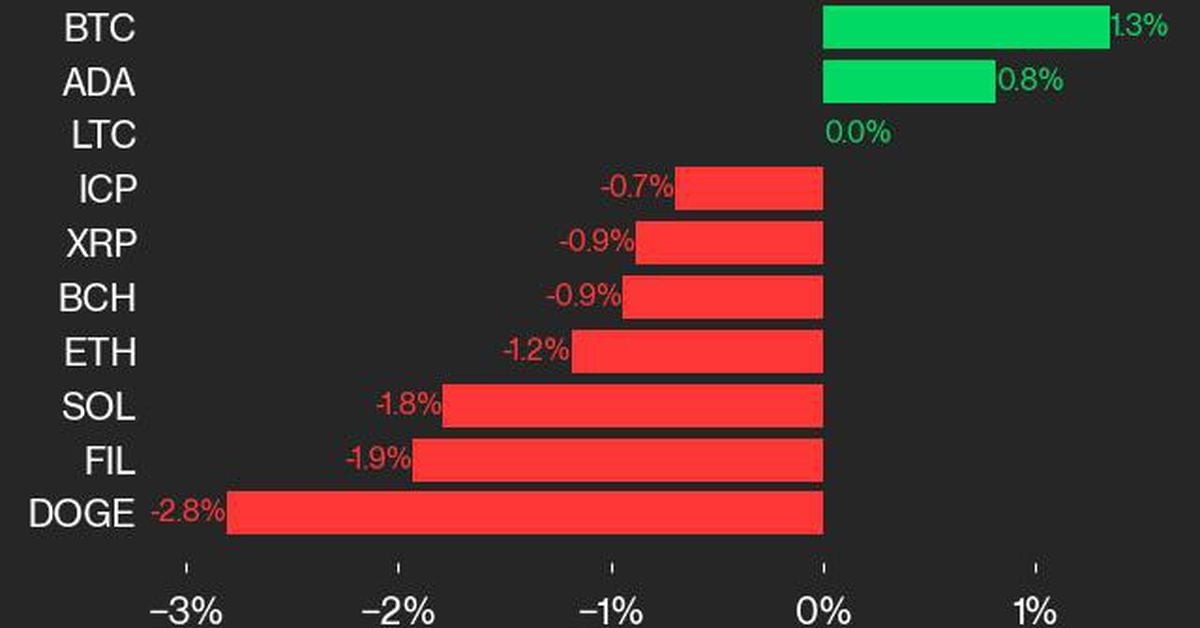

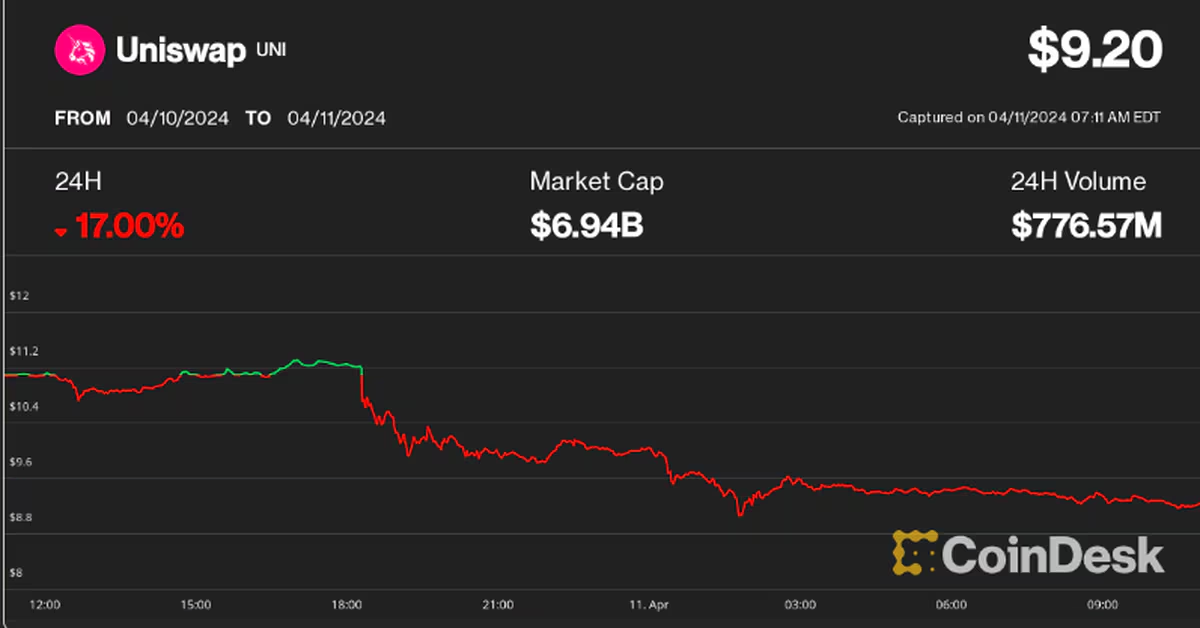

Uniswap's UNI token has recently declined but could see a bullish revival if Bitcoin and DeFi sentiment improve, with potential resistance levels at $12, $15, and $19, depending on market conditions and a breakout above key support levels.