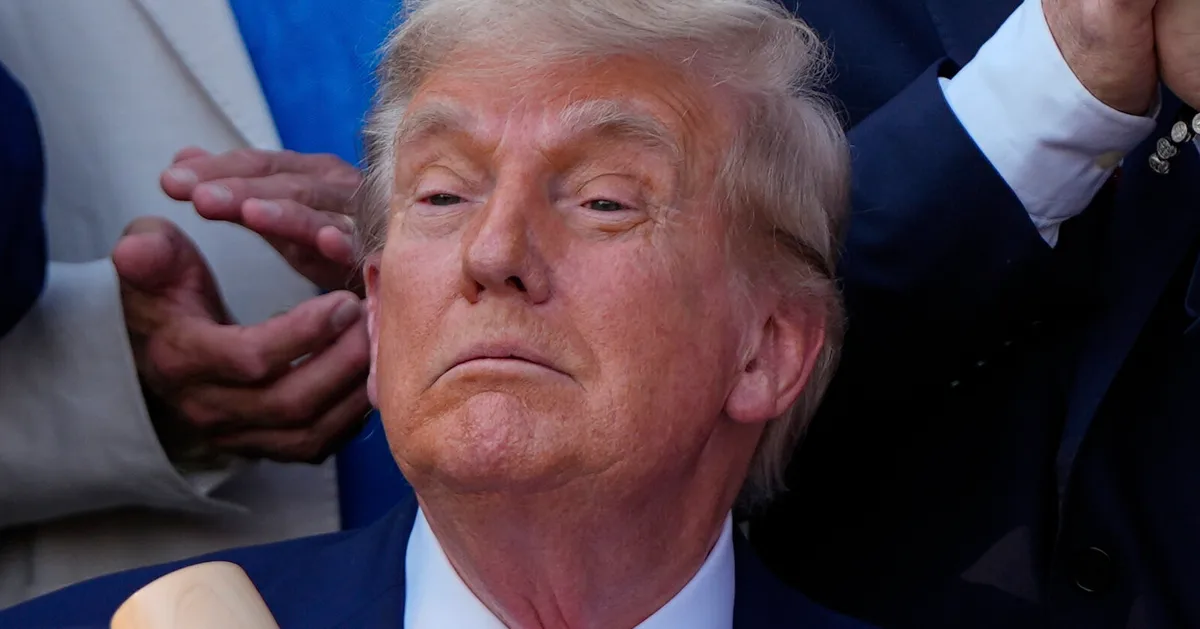

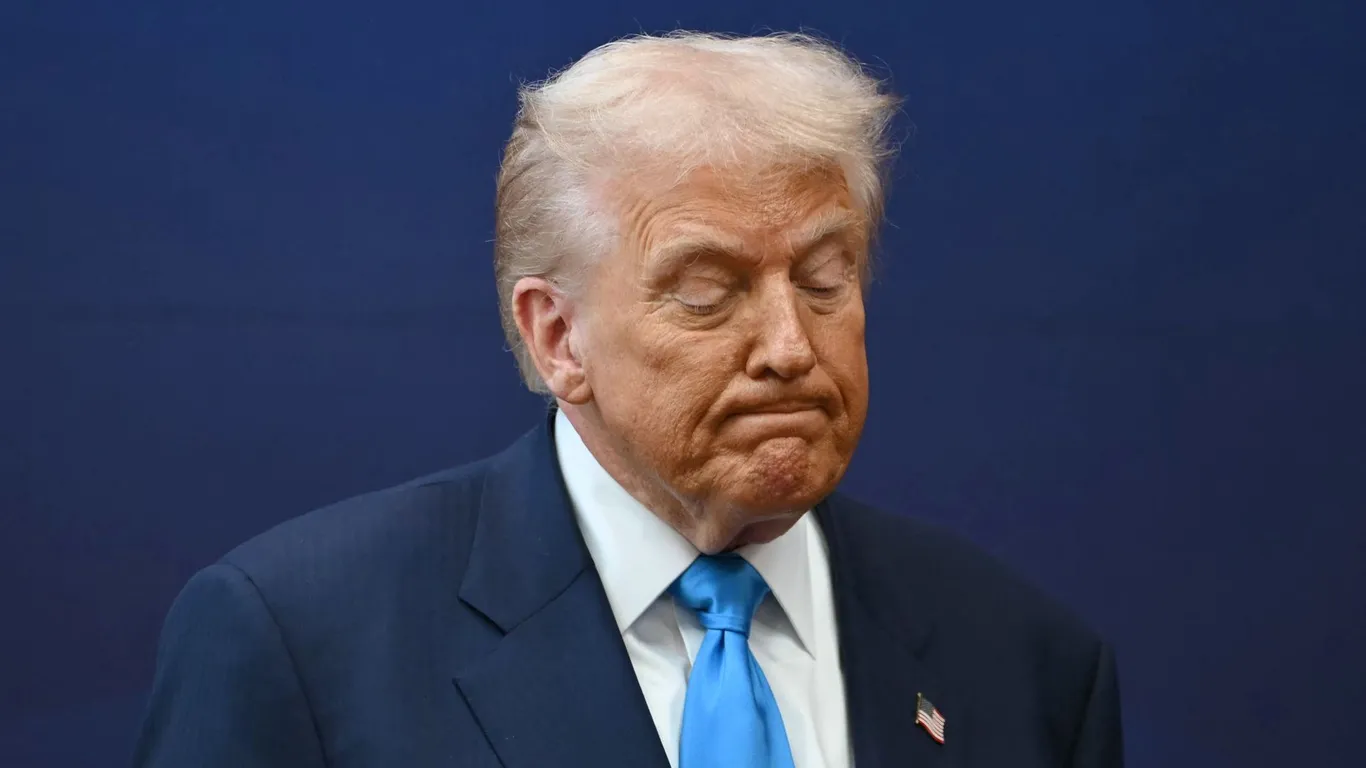

Trump's Wealth Grows in 2025 Despite Investor Losses

In 2025, Donald Trump's wealth increased significantly, largely due to crypto gains and business deals, but retail investors who invested in his publicly traded assets and memecoin faced substantial losses, highlighting the risks of investing in volatile assets linked to high-profile figures.