Warren Buffett's Top Investment Tips for 2026

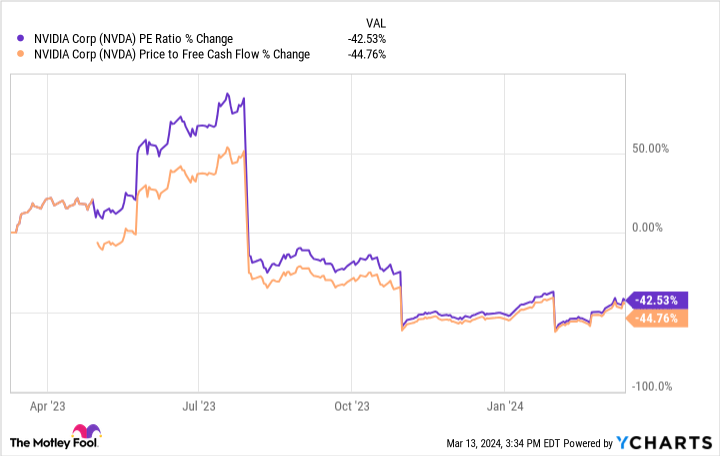

Warren Buffett's two-step test for stock investing involves first determining if future earnings can be sensibly estimated for at least five years, and second, if the stock's valuation is reasonable relative to those projected earnings. While simple in concept, accurately estimating future earnings remains a significant challenge.