California Faces Budget Challenges as Pandemic Aid Ends

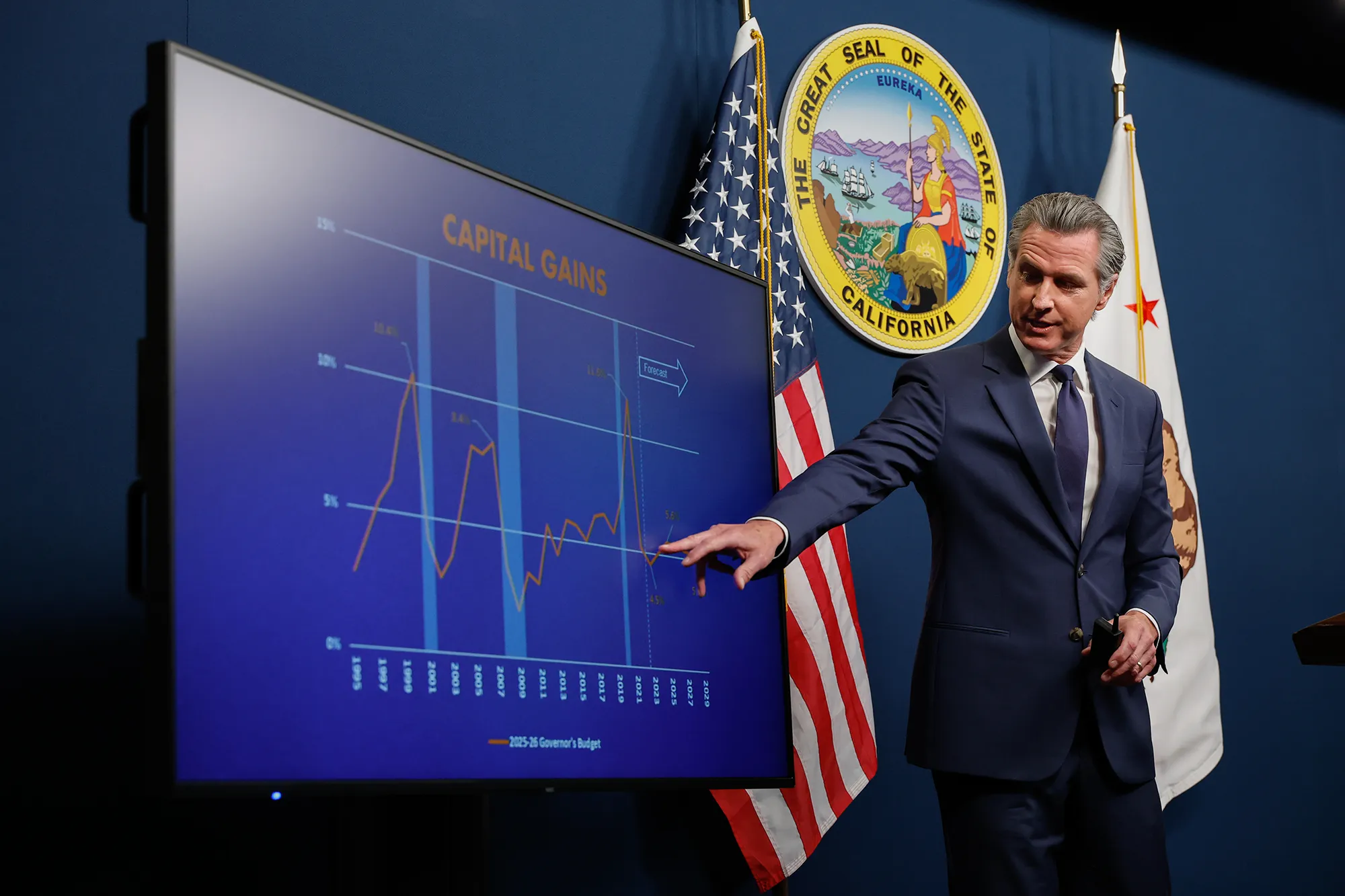

California's budget outlook has worsened from a surplus to an $18 billion deficit due to unforeseen costs like wildfires, Medi-Cal expenses, and federal policy impacts, with projections indicating ongoing deficits and potential structural issues requiring revenue increases or cuts.