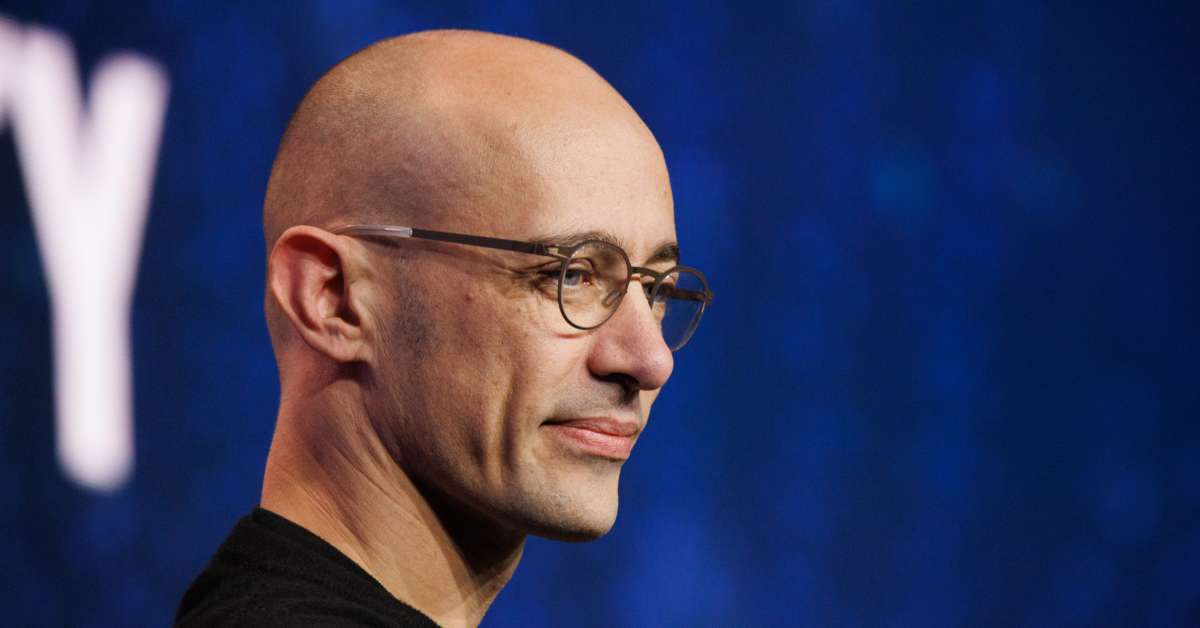

AI Won’t Replace Software, Nvidia’s Huang Says — 3 Beaten SaaS Bets to Watch

Nvidia CEO Jensen Huang argues that AI will augment existing software rather than replace it, challenging fears of a software downturn driven by AI. The Motley Fool highlights three beaten-down SaaS picks after the sell-off: Microsoft, Shopify, and Figma, noting AI integration and solid growth potential, but warning that elevated valuations could temper upside in some cases.