The Changing Appeal of I Bonds and Bond Investments

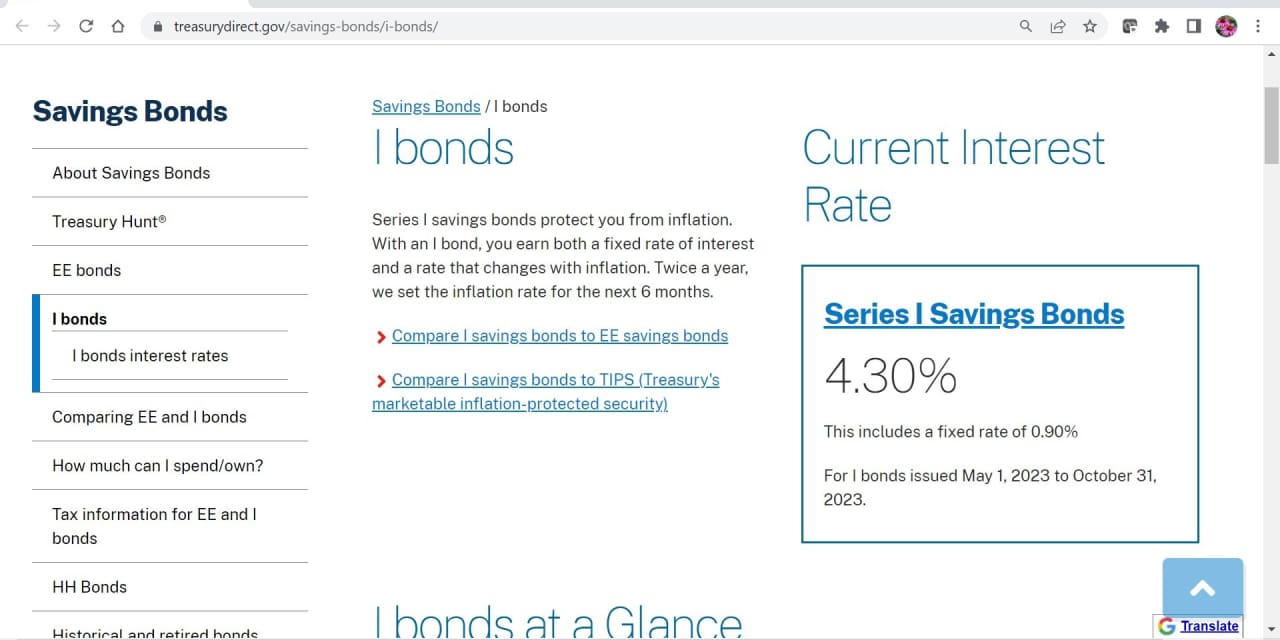

The US Treasury Department has announced two key improvements to I bonds, making them more attractive for investors. First, the annualized yield for new I bond purchases made through April has increased to 5.27%, up from the previous 4.30% annual return. Second, the fixed rate for I bonds has risen to 1.30%, up from 0.9% for the past six months. This fixed rate will ensure a return above inflation for the next 30 years, making I bonds a safe and attractive long-term investment option. I bonds are government-backed savings bonds tied to the Consumer Price Index, providing protection against inflation.