Tesla's 2026 Wishlist: From Forever FSD to an Affordable Model 2 and Beyond

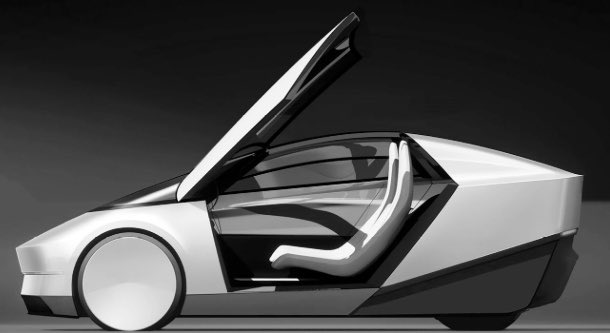

An opinion-piece wishlist for Tesla in 2026 envisions making Full Self-Driving a true software license owned by the user, unveiling a $25,000 Model 2 compact EV and a true 6/7-seat family SUV (CyberSUV), delivering the Roadster, offering HW3 retrofits and MCU4, adding a 360° parking view, expanding V2H/V2L across the lineup, native Starlink connectivity, a Tesla App Store, expanded Theater and Steam support, in-app energy arrival features, more customization options, adjustable speed control, and a Tesla-branded home heatpump—framed as aspirational ideas rather than confirmed plans.