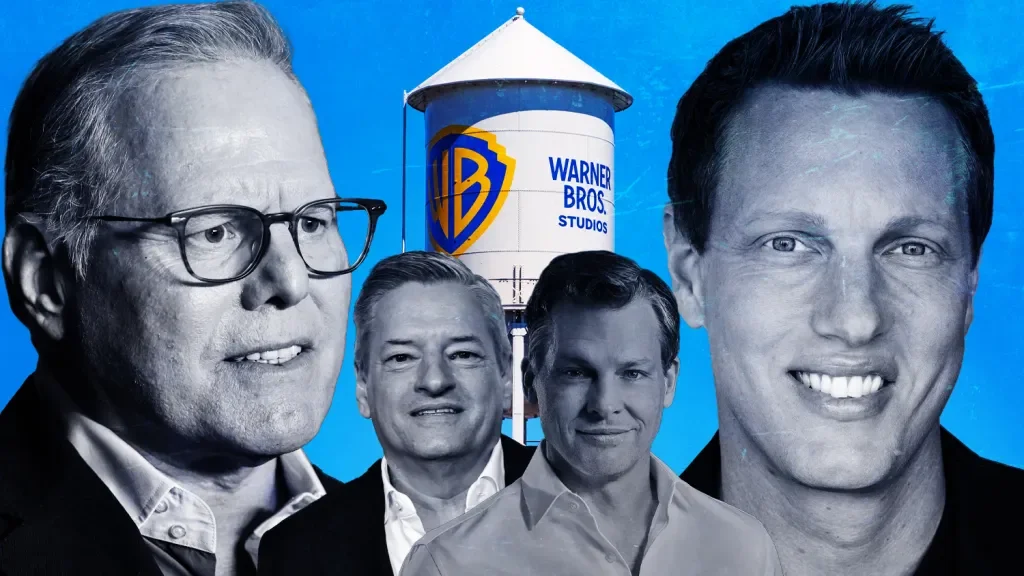

Paramount Hikes Bid in High-Stakes WBD-Netflix Battle

Paramount has sweetened its offer to acquire Warner Bros. Discovery as negotiations with Netflix-backed WBD move under a tight seven-day window, with the exact increase over the previous $30-per-share bid not disclosed. Netflix retains the right to match any bid, and WBD has signaled Paramount might push above $31 a share in talks aimed at preventing a Netflix-led outcome. Financing guarantees are a concern in what would be the largest leveraged buyout in history. The discussions come ahead of a Warner shareholder meeting and a deadline through tonight, possibly extending to March 3; Paramount declined to comment, with an official statement expected before the market opens.