Gas rallies, metals surge and Japan’s bond jitters set a volatile 2026 pace

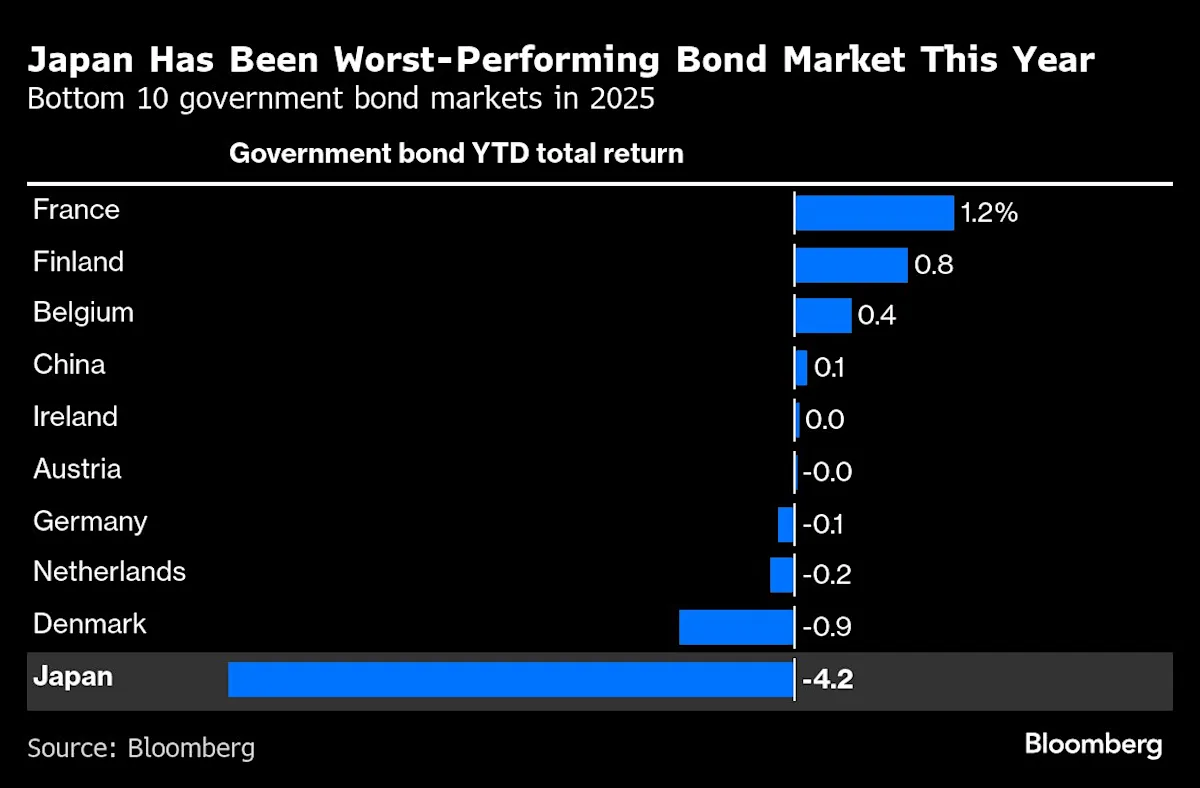

Investors started 2026 amid a flurry of dramatic moves: natural gas futures jumped more than 60% in three days, silver topped $100 an ounce while gold neared $5,000, and the Russell 2000 outperformed the S&P 500 as Japanese 40-year bonds surged, signaling broad, volatile action across commodities, equities and debt markets.