Japan's Bond Market Turmoil Sparks Global Investor Interest

TL;DR Summary

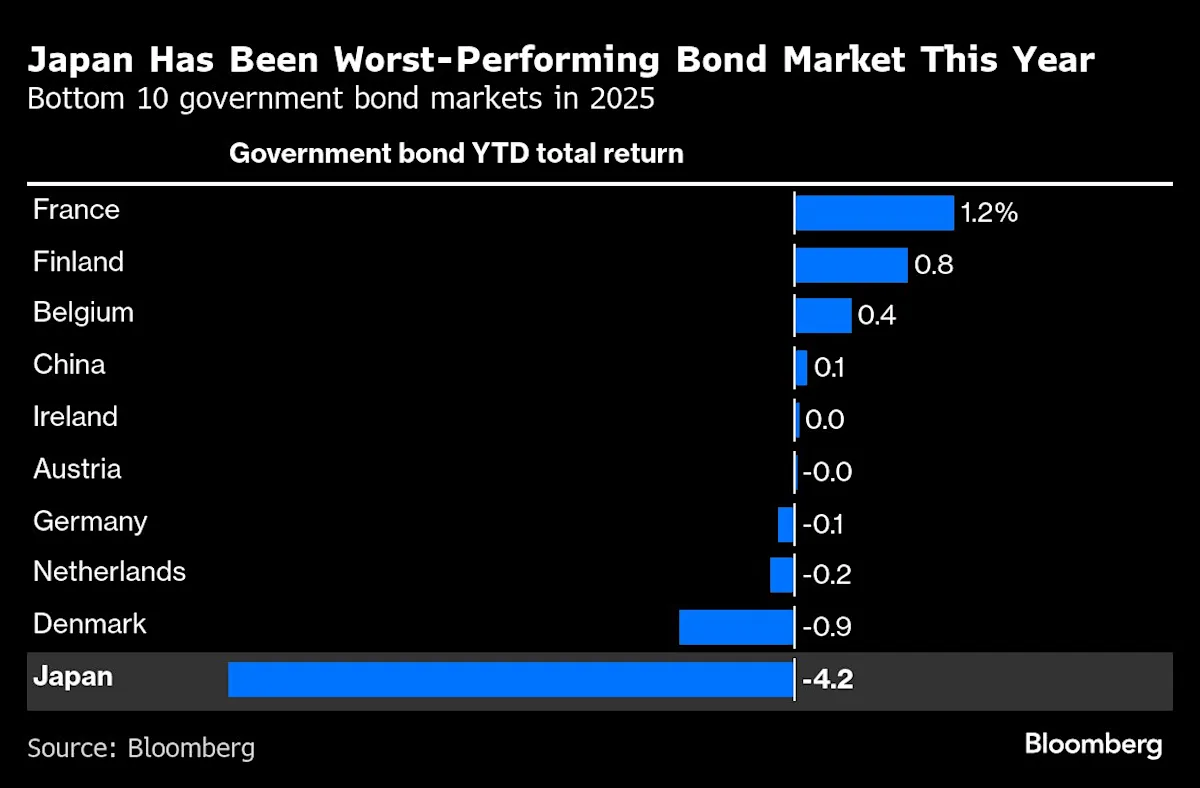

The 'widow-maker' trade, a strategy of shorting Japanese government bonds, has become highly profitable as Japanese bonds have plummeted over 4% this year due to rising yields, inflation concerns, and fears of fiscal policy changes, making it one of the most lucrative bets in the global bond market.

- ‘Widow-Maker’ Trade Becomes World Beater as Japan Bonds Sink Yahoo Finance

- Foreign money spurs wilder twists in Japan's sedate bond yield curve Reuters

- Japan household investment in JGBs needed: former Finance Ministry director Nikkei Asia

- Targeting Japanese Bonds! Is the 'Widowmaker Trade' Taking the World by Storm? 富途牛牛

- Vanguard Positions for BOJ Hikes to Flatten Japan’s Yield Curve Bloomberg.com

Reading Insights

Total Reads

0

Unique Readers

1

Time Saved

2 min

vs 3 min read

Condensed

90%

481 → 48 words

Want the full story? Read the original article

Read on Yahoo Finance