"Global Markets Await Fed's Rate Decision as Stocks Hit Record Highs"

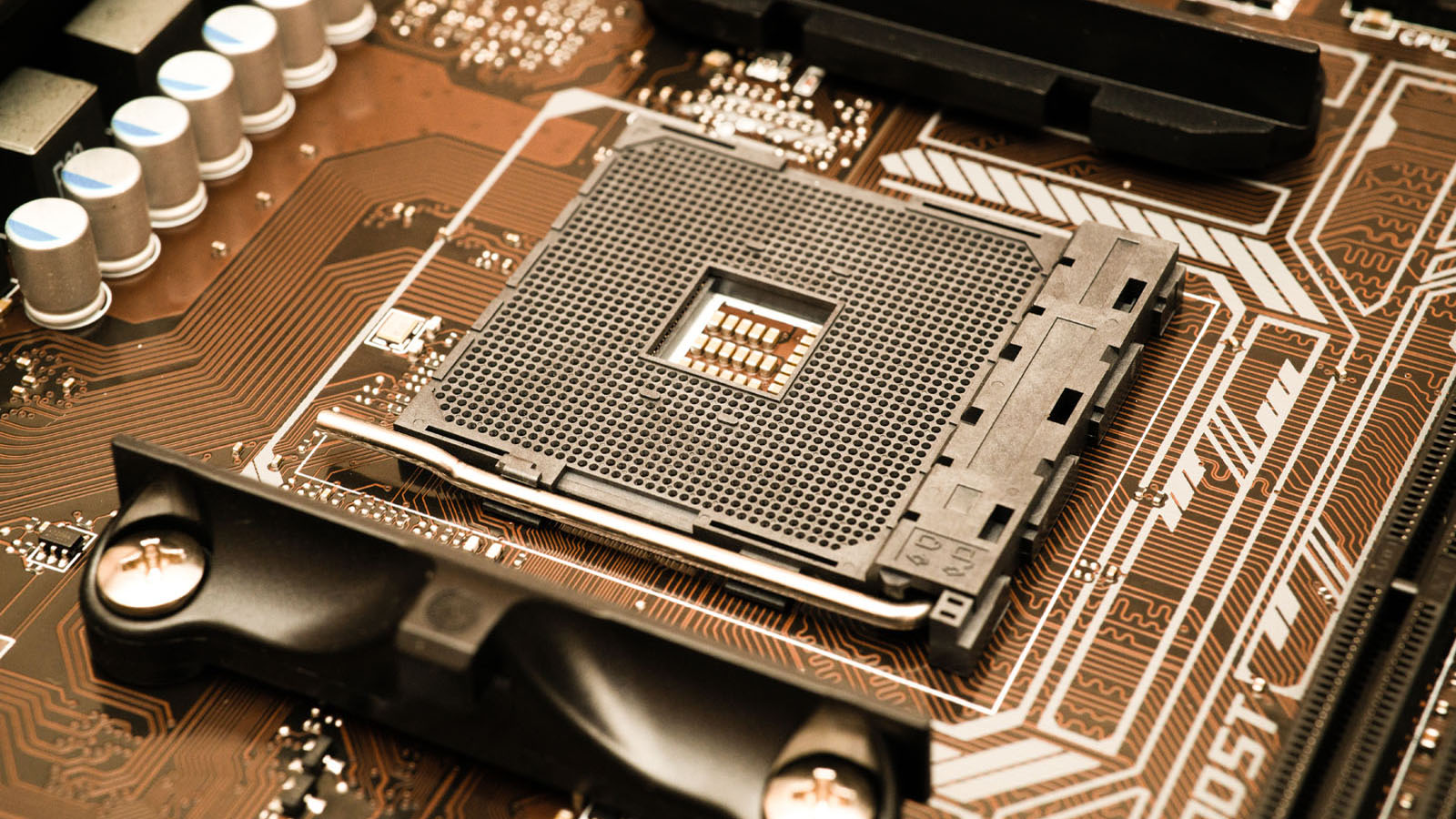

Luxury stocks in Europe, including Kering SA, LVMH, Burberry Group Plc, and Christian Dior SE, faced losses after Kering warned about declining sales, raising concerns about high-end consumer spending in China. Treasuries and US equity futures remained steady ahead of the Federal Reserve meeting. Meanwhile, Intel Corp. saw a rise in premarket trading after securing nearly $20 billion in US grants and loans.