China Eases Export Restrictions on Critical Minerals to the US

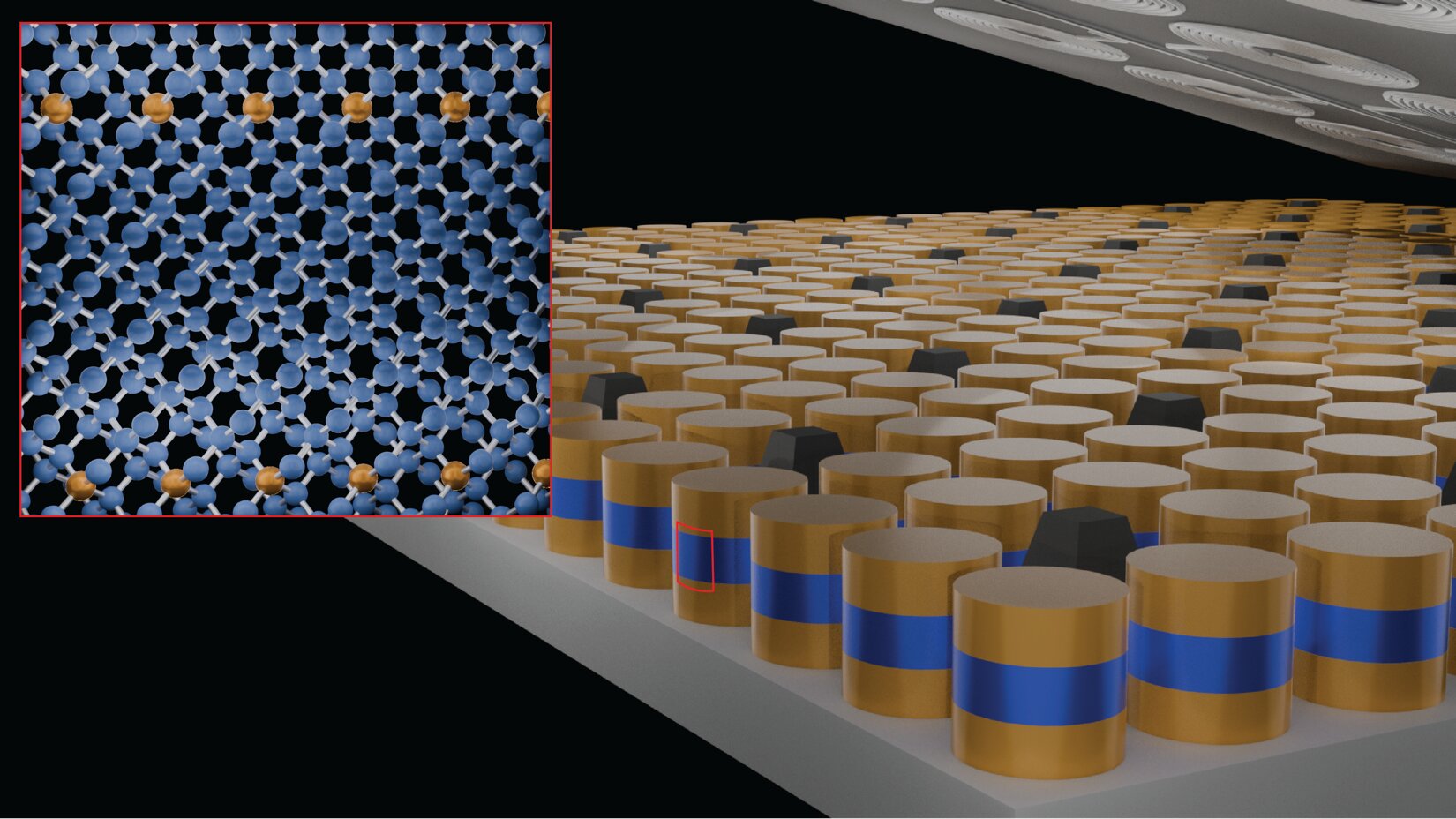

China has lifted a nearly year-long export ban on gallium, germanium, and antimony to the US, signaling a de-escalation in trade tensions. The ban, initially imposed in December 2024 in response to US export controls, affected critical minerals used in semiconductors, military, and technology sectors. The suspension will last until November 27, 2026, and aims to ease supply chain disruptions and trade disputes between the two countries.