Global Markets End 2025 on a High Despite Turmoil and Uncertainty

Global stock markets experienced significant gains in 2025, largely unaffected by ongoing trade tensions, reflecting resilience in financial markets.

All articles tagged with #gains

Global stock markets experienced significant gains in 2025, largely unaffected by ongoing trade tensions, reflecting resilience in financial markets.

The top 20 best-performing hedge funds made $67 billion in gains in 2023, triple the amount reported in 2022, as stock markets surged. This strong performance reflects the growing divide between the industry's top players and others, with the top 20 firms representing 46% of the sector's total lifetime gains despite overseeing just under 19% of the industry's assets under management. TCI, an activist hedge fund, led the pack with $12.9 billion in net gains, while big firms like Bridgewater Associates reported losses. The rally in stock markets has particularly benefited hedge funds making focused bets on individual stocks, with many heavily invested in tech giants like Alphabet, Amazon, and Apple.

BMO Capital Markets suggests that it's time to embrace the bull market in stocks, as the S&P 500 index officially entered a new bull market in June, recovering more than 20% from its bear-market low. They predict potential gains of 12% in the coming year.

U.S. stocks have been performing exceptionally well this year, but experts predict that the gains may not be as significant in 2024. While history suggests that equities tend to outperform, it is unlikely that they will see the same level of success as this year.

The Dow Jones Industrial Average surged nearly 300 points following a surprising jobs report, which showed that the US economy added 943,000 jobs in July, surpassing expectations. The strong employment data boosted investor sentiment and led to gains in the stock market.

Despite August historically being a challenging month for the S&P 500, there are eight stocks that have consistently outperformed during this period in the past five years. These stocks include Insulet, EPAM Systems, and Norwegian Cruise Line, with average gains of 4.4% during August, double the S&P 500's gain. Investors are seeking winning stocks in August as the S&P 500 has already posted a significant year-to-date gain.

Ukraine is working to consolidate its recent gains against Russia in the war, but they are facing fierce resistance.

Ukraine's counteroffensive against Russian forces has been successful in the past few days, with gains reported around the city of Bakhmut despite fierce resistance. Ukrainian President Volodymyr Zelenskiy stated that progress has been made after a challenging week. The Ukrainian Defense Forces are focused on destroying Russian manpower, equipment, and military infrastructure. However, Russia still holds significant territory in eastern and southern Ukraine. Both sides claim heavy losses, and the situation on the battlefield remains difficult to verify.

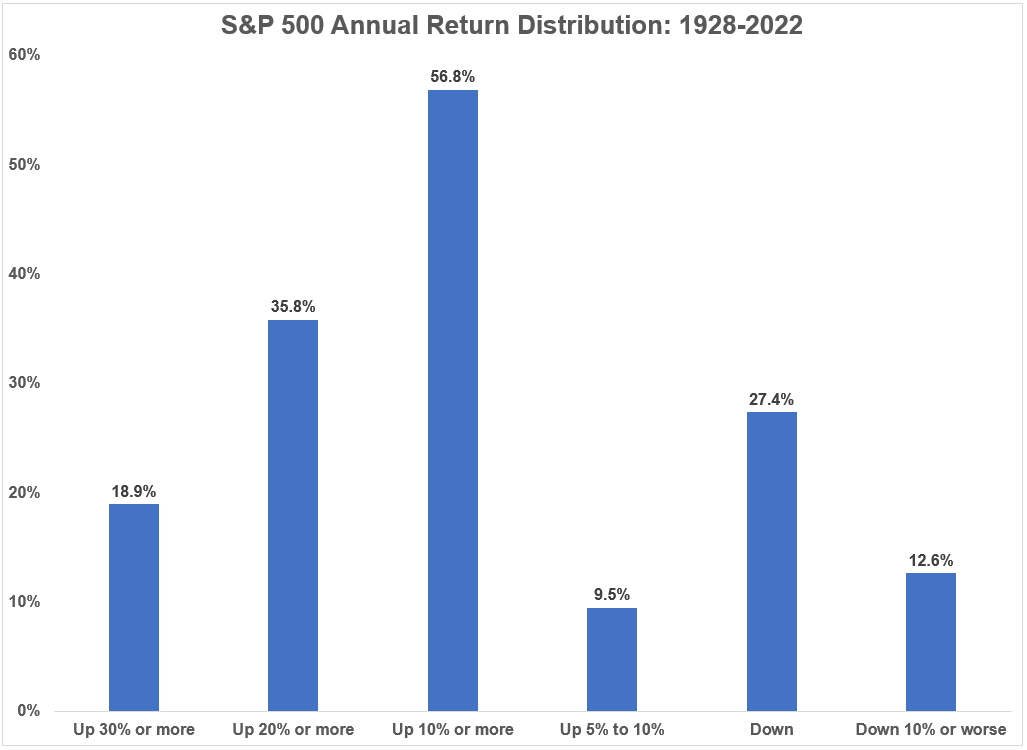

The US stock market has historically been more likely to finish the year up 20% or more than down on the year, with almost 6 out of every 10 years seeing gains in excess of 10%. However, large drawdowns also occur more often than some people assume, with an average intrayear drawdown of -16.4% since 1928. Investors should expect the possibility for both big gains and big losses, as the stock market is constantly toying with emotions.

Ukrainian troops have made early gains against "well-prepared" Russian forces in the ongoing conflict in eastern Ukraine, according to a military briefing. The Ukrainian military said it had taken control of several villages and strategic heights in the Donetsk region, while Russian-backed separatists accused Ukraine of violating a ceasefire agreement. The conflict, which began in 2014, has claimed more than 13,000 lives and shows no signs of abating.

The stock market has been gaining as the "wall of worry" crumbles, with investors becoming more optimistic about the future. However, some analysts warn that this could lead to complacency and a potential market correction. It is important for investors to remain cautious and keep an eye on market trends.

Oppenheimer has downgraded a cosmetics stock, stating that future gains will be harder to come by.

Several stocks are breaking out to the upside and may be poised for further gains, according to analysts. Bank of America has identified 10 global stocks that analysts love coming out of the earnings week. Meanwhile, Warren Buffett owns several stocks that analysts also love, and there are seven stocks that fit his buying criteria ahead of Berkshire's annual meeting.