Ex-Bank of America Employee Allegedly Steals $500K from Disabled Woman in Miami-Dade

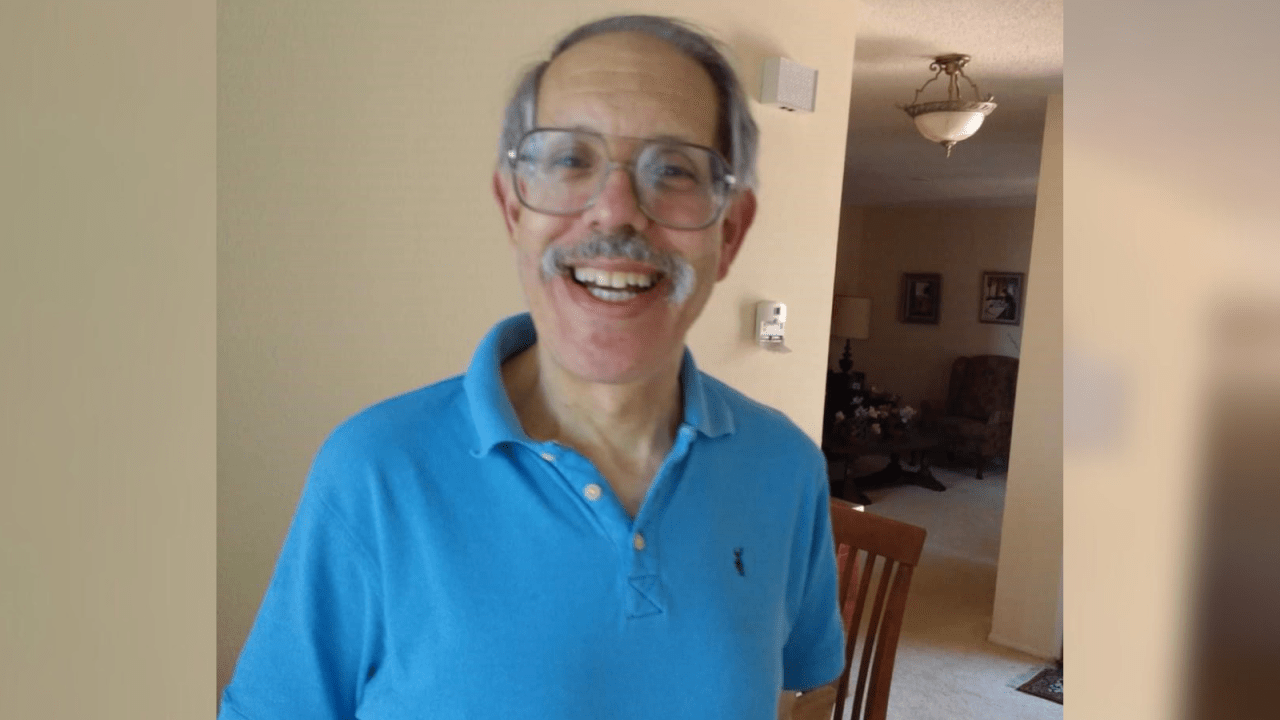

A Bank of America employee, Mario Martinez, is accused of exploiting a disabled woman and stealing over $500,000 from her after offering to help manage her inheritance, opening joint accounts without her consent, and siphoning her funds over several months. He faces multiple charges including exploitation and grand theft, and is currently held in custody awaiting court proceedings.