Ex-Bank of America employee charged with $500K theft from disabled client

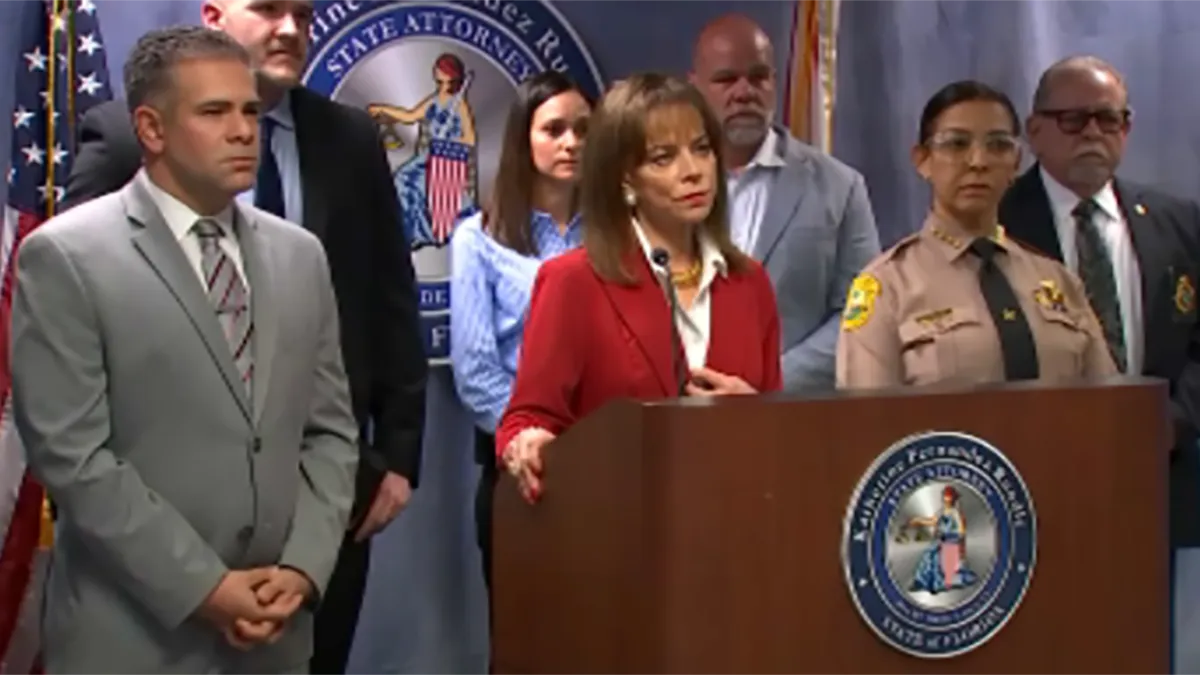

A former Bank of America employee in Miami-Dade was arrested for allegedly stealing $500,000 from a disabled woman he knew, exploiting her trust and his position at the bank, after an internal investigation revealed his scheme.