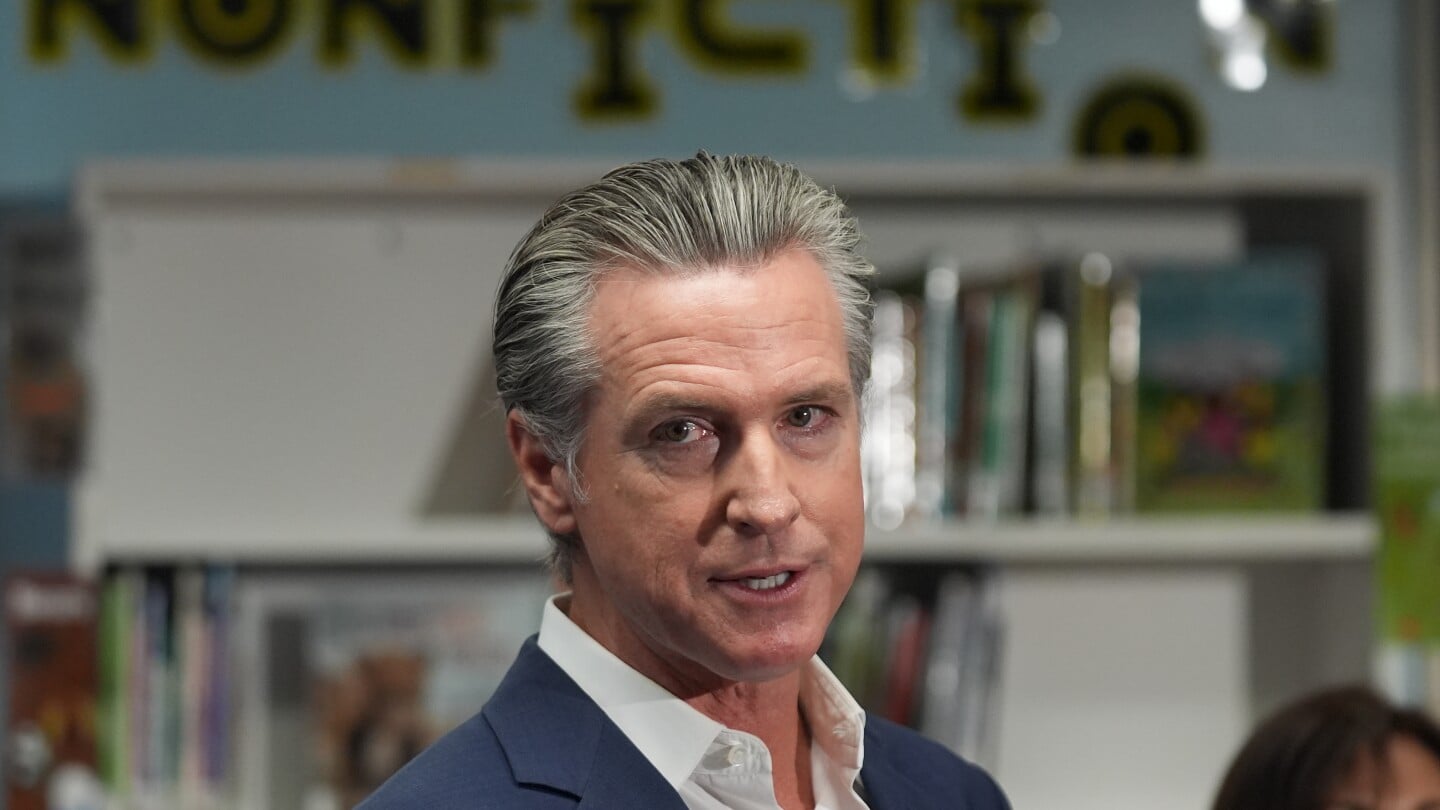

California Implements Reforms to Stabilize Insurance and Address Rate Hikes

California Governor Gavin Newsom signed bipartisan legislation to bolster the state's home insurer of last resort, the FAIR Plan, by allowing it to request state-backed loans and spread out claims payments after disasters, aiming to prevent insolvency amid increasing wildfire risks due to climate change. Additionally, new laws expand oversight of the FAIR Plan board to improve transparency and stability in California's insurance market, which is under pressure from rising wildfire damages and insurer withdrawals.