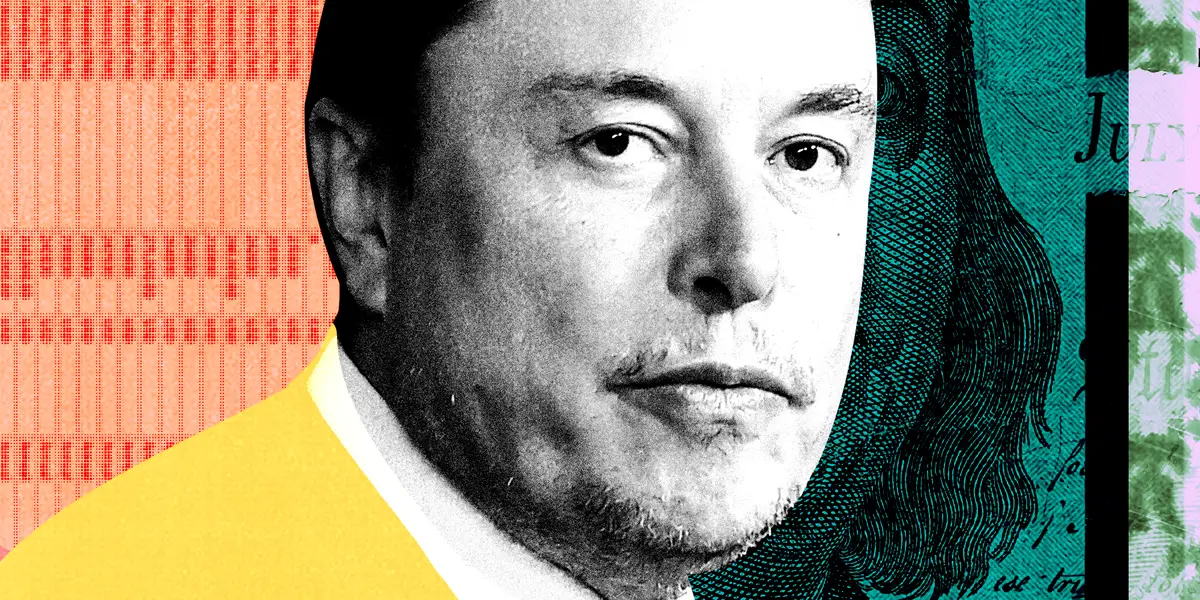

Musk Intensifies Legal Battle Against OpenAI and Microsoft Over Compensation and Antitrust Issues

Elon Musk has expanded his lawsuit against OpenAI by adding Microsoft and Reid Hoffman as defendants, accusing them of creating an AI monopoly through anticompetitive practices, including offering 'lavish compensation' to employees. Musk claims OpenAI's high salaries, with median compensation for software engineers at $810,000, are part of a strategy to dominate the AI talent market. OpenAI, which Musk co-founded but later left, has been criticized by him for prioritizing commercial interests over its original nonprofit mission.