Coca-Cola at Record Highs, Dutch Bros on a Growth Drive: Two Beverage Bets for 2026

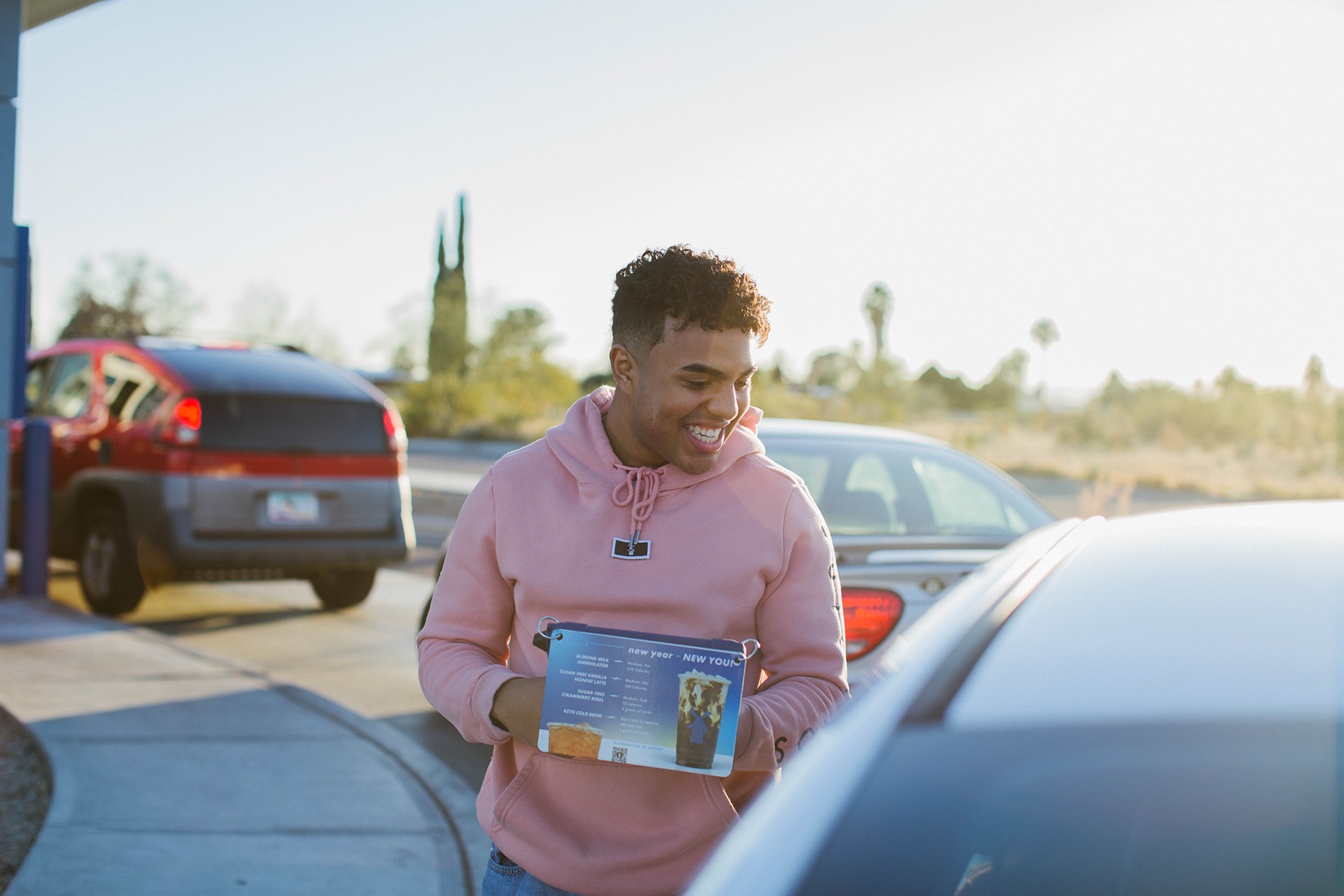

The Motley Fool highlights Coca-Cola and Dutch Bros as two contrasting beverage bets for 2026: Coca-Cola is making all-time price highs on steady volumes and pricing power despite a CEO transition, trading around 24x trailing earnings with a solid ~2.7% dividend; Dutch Bros has doubled its store count in five years, expanded nationwide with strong revenue and net income growth, but trades at a premium for its growth story after pulling back from recent highs. Together they offer diversified exposure within the beverage space and different risk/reward profiles for investors.