Market Records and Party Drama: Unsettling Events Unfold

Stocks recently achieved a record close, but market analyst Katie Stockton is cautious and watching for signs of a potential downturn, despite the positive close.

All articles tagged with #downturn

Stocks recently achieved a record close, but market analyst Katie Stockton is cautious and watching for signs of a potential downturn, despite the positive close.

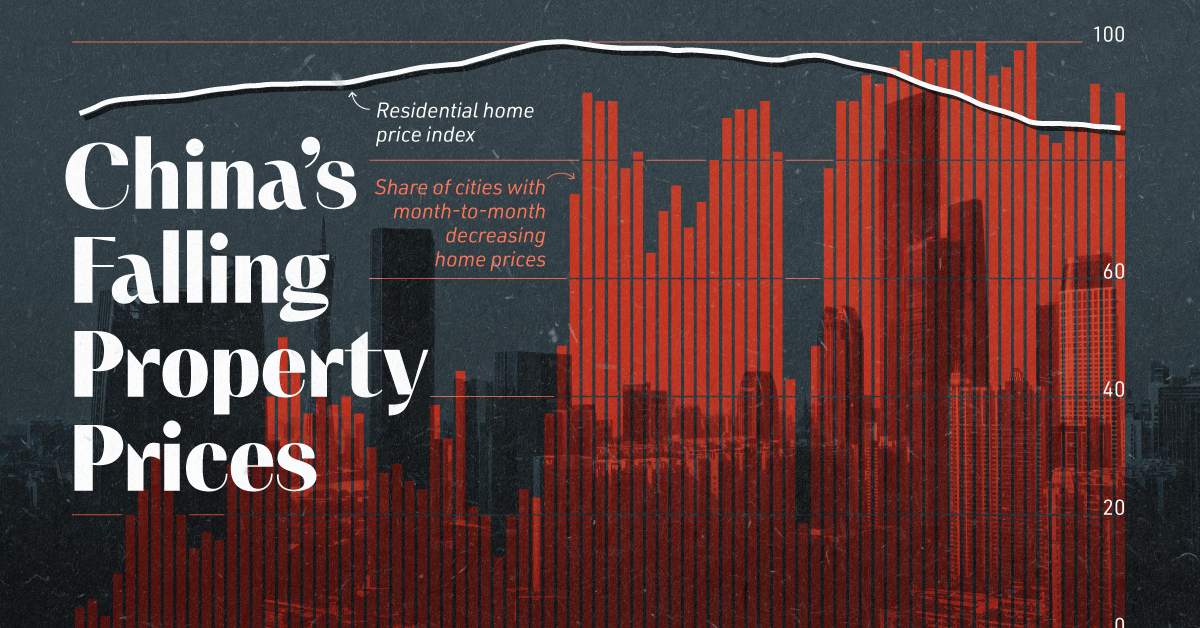

China's real estate market is experiencing a significant downturn, with over 90% of cities seeing month-to-month price declines since late 2023 and a 14% drop in the residential home price index since August 2021, driven by structural weaknesses, regulatory restrictions, and developer debt, although high-end markets like Shanghai still attract wealthy buyers.

Manufacturing activity in the Eurozone has picked up, leading to a slight easing of the economic downturn in the region. This positive development suggests a potential for growth in the Eurozone economy.

The Israeli high-tech industry is experiencing its worst downturn ever, surpassing previous setbacks such as the dot-com bubble and the Great Recession. The outlook for 2024 appears grim due to ongoing conflict, a challenging global economy, and a government mired in corruption, posing further challenges for the "Start-Up Nation."

China's economic data for August suggests that the downturn in growth may be stabilizing, with industrial production and retail sales showing improvement. Investment in fixed assets also grew, indicating a potential turnaround. Despite concerns over weak export demand and a property crisis, economists believe that the worst may be over for China's economy. The People's Bank of China recently made a surprise cut to the reserve requirement ratio to support economic recovery. However, economic data has not yet shown a sustained recovery trend, with consumer prices remaining listless.

JPMorgan's purchase of First Republic caused regional bank shares to plummet, while CEO Jamie Dimon warns of a potential commercial real estate downturn.

Warren Buffett predicts a downturn and suggests that inflation data and earnings will indicate its severity. Despite the strength of the US labor market, the threat of recession still looms.