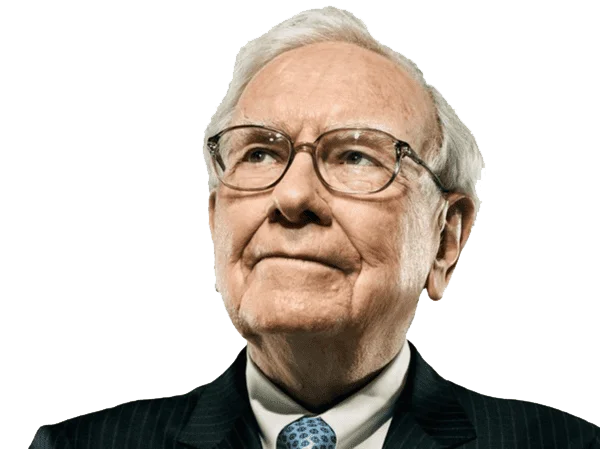

Buffett Sells Majority of Amazon, Bets $352M on The New York Times

Berkshire Hathaway dumped about 7.7 million Amazon shares (roughly 75% of Buffett’s AMZN stake) in Q4 and instead invested about $352 million in The New York Times Company. NYT stock has surged about 52% in the last year to $75.50, while NYT digital subscriptions rose by 780,000 year over year to 12.21 million and revenue increased 10.4% to $802.3 million, signaling Buffett’s rotation toward a brand-name media asset amid AI-driven tech valuations.