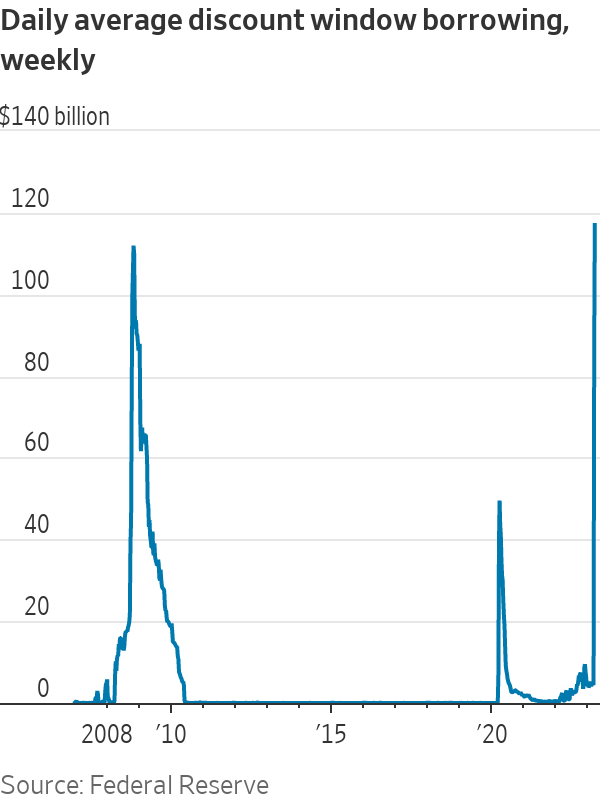

Fed lending to banks fluctuates as borrowing habits shift.

Bank borrowing from the Federal Reserve's primary lending window has declined, indicating that pressures banks faced are receding. Borrowing from the window is meant to help banks deal with short-term liquidity crunches and is generally seen as a sign of weakness. The trend lower supports the narrative that bank runs, or fear that they could happen, aren’t forcing lenders to borrow from the Fed. The resurgence in mid-March from the discount window indicated that banks were under pressure.