"Texas Oil Tycoons Forge $76 Billion Megadeal in Permian Basin"

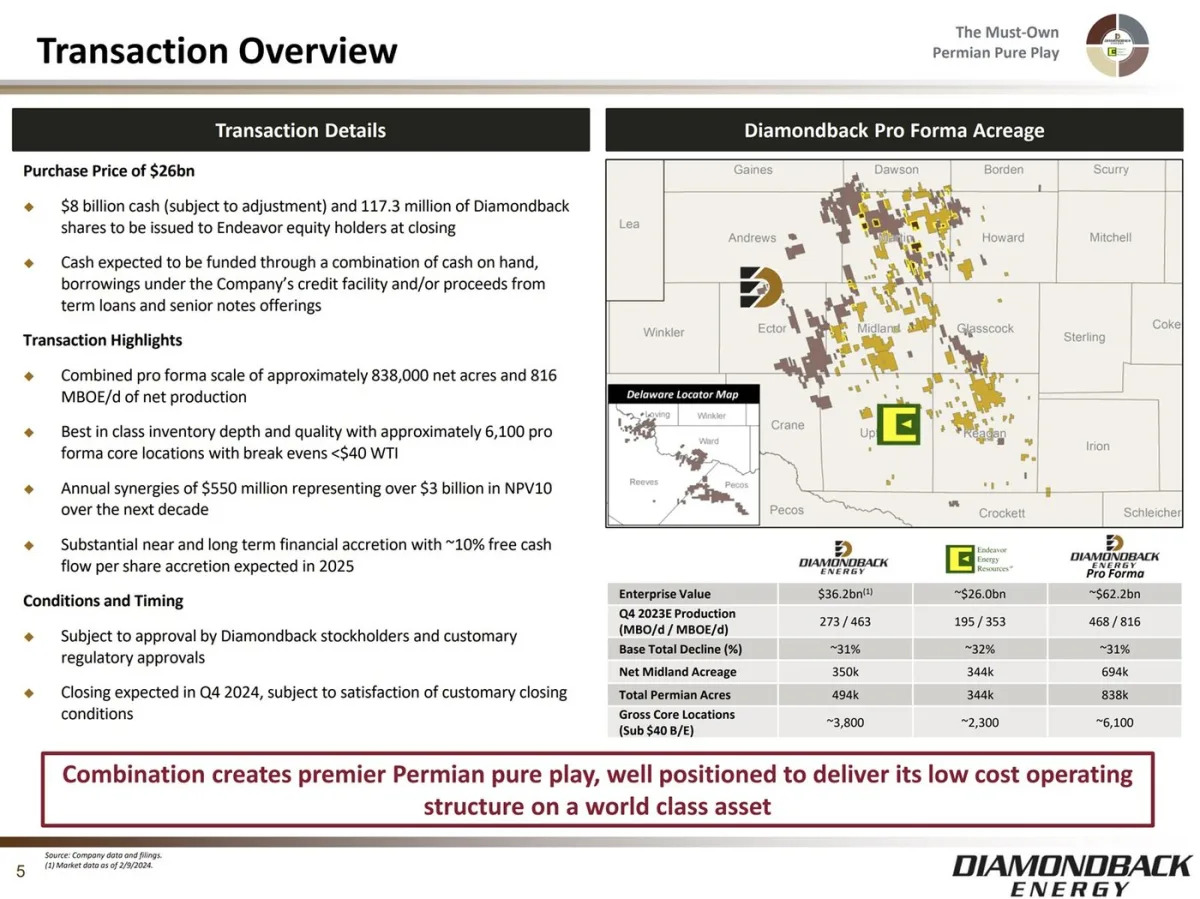

Autry Stephens, an 85-year-old oil tycoon, recently sold his company, Endeavor Energy Resources, to Diamondback Energy for $26 billion, making him one of the richest people in the world. Despite this, Stephens expressed reluctance about the sale, citing his attachment to the company and its employees. His unassuming style and modest upbringing have shaped his approach to wealth, and he has yet to decide how to spend his newfound billions.