Bitcoin Surges to New Record High Above $126K Amid Market Rally

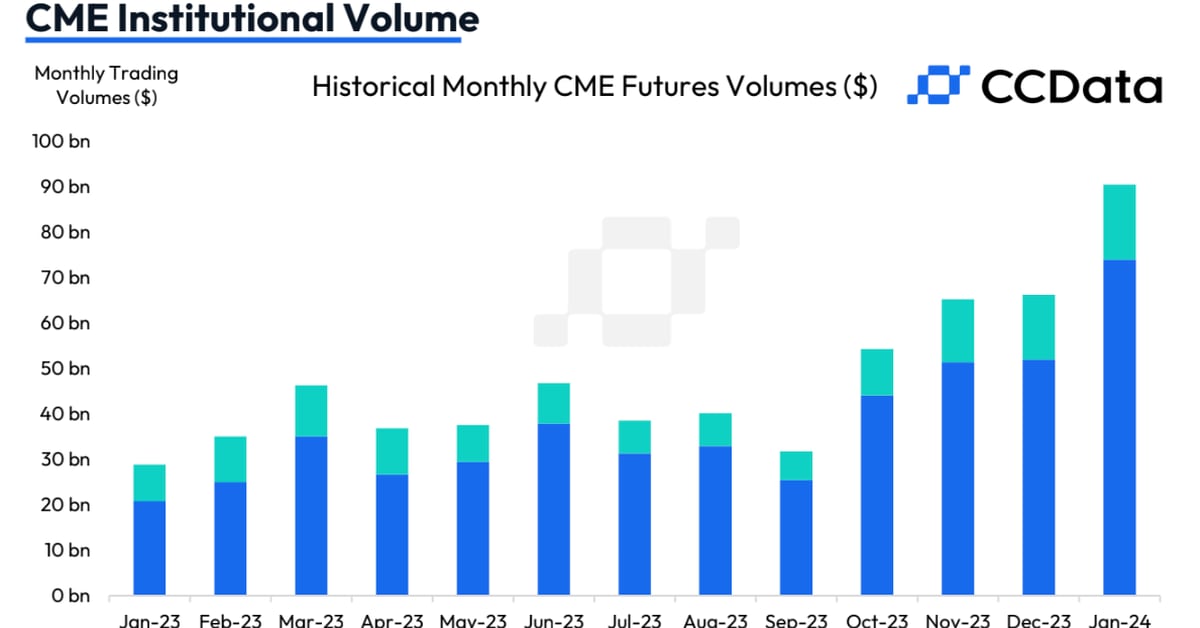

Bitcoin's recent record rally has led options traders to bet on a potential rise to $140,000, with open interest around that strike price, amid a surge in demand driven by safe-haven demand during a US government shutdown and increased spot market activity. Despite the rally, traders remain cautious about volatility and potential corrections, with some seeing opportunities in overbought conditions.